- Home

- >

- Daily Accents

- >

- The most important of the FED statement

The most important of the FED statement

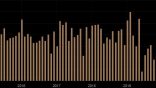

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

Policy makers agreed to raise their benchmark lending rate for the third time in six months, maintained their outlook for one more hike in 2017 and set out some details for how they intend to shrink their $4.5 trillion balance sheet this year.

Policy makers also issued forecasts showing another three quarter-point rate increases in 2018, similar to the previous projections in March.

Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the committee’s 2 percent objective over the medium term.

The recent economic developments prompted FOMC members to drop their median projection for inflation to 1.6 percent in 2017, from 1.9 percent forecast in March. The median forecasts for 2018 and 2019, however, were unchanged at 2 percent.

* Economic-growth projections were little changed, with the median forecast for 2017 moving to 2.2 percent from 2.1 percent.

* The FOMC next meets in six weeks, on July 25-26.

* FOMC hikes rates to 1.00%-1.25%, as expected

* Maintains forecast for one more hike in 2017

* Says it's 'monitoring inflation developments closely'

* Sees economy and job market on more solid footing, now sees unemployment rate falling to 4.2% through 2019

* Household spending has picked up and fixed investment has continued to expand

* Could put balance sheet plan in place relatively soon

Source: Bloomberg Pro Terminal

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.