- Home

- >

- Daily Accents

- >

- What is the most important to know about Non Farm Payrolls today

What is the most important to know about Non Farm Payrolls today

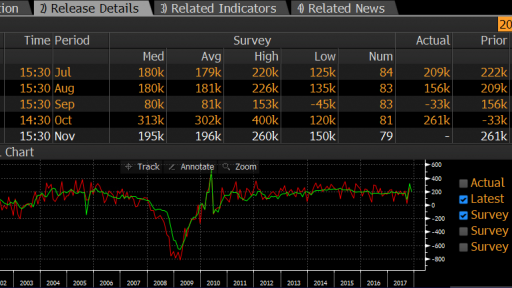

New jobs in the United States are expected to return to average values of around 185K, as previous data was heavily influenced by hurricanes Harvey and Irma. The data we expect today is the first "clean data" that will actually show how the US economy is doing. This will lead to a greater impact on USD and indices than previous data.

What to expect from the November Job Report:

1. Payrolls: Analysts expect the US economy to add 195 new jobs to help bring the country's 4.0% unemployment rate. A decrease in unemployment to these levels will also have a strong positive effect on pay as, at very high levels of employment, companies are starting to have difficulty finding high-quality jobs and willing to pay more. For this reason, we expect investors to focus on the number of new jobs.

2. Unemployment: The consensus forecast for economists is that the unemployment rate remains at the current levels of 4.1%, but with better data on new jobs, the outlook for unemployment in the country remains positive. Taking into account the small probability of observing a change in the value of this indicator, if any, we expect a strong impact on USD in that direction.

3. Average hourly wage: The market participants' expectations for this indicator remain at the level of 0.3% on a monthly basis and growth to 2.7% on an annual basis. Data will be the first clean data after hurricanes, with no dramatic changes in value. However, a greater number of new jobs will cause investors to trade and raise wages after a subsequent fall in unemployment.

So far, the expectations for the November Job Report are good, but let's take a look at what's been published last month about the US labor market:

In spite of the positive forecasts of most economists, the facts for November are eloquent, most of the data on the US labor market were worse than those in the previous month, and this increases the possibility today to publish worse data than expected .

Given the strong positive expectations and partly their accumulation in the US dollar and US indices, we expect lower data in the downward direction of the dollar and a limited impact on the indices. For better data, we expect US dollar and index growth, as well as a fall in JPY and Gold. Better data will also be in support of rising interest rates next year.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.