- Home

- >

- Opportunities for profit today

- >

- The NAFTA deal is getting closer. Here’s how and where to position yourself

The NAFTA deal is getting closer. Here's how and where to position yourself

The US administration said Canada should sign the text for NAFTA update by midnight (07:00 local time) or withdraw from the Pact.

Trump accuses NAFTA of losing jobs in the United States and wants major changes to the pact, which is the basis of $ 1.2 trillion a year of trade. Markets fear that Canada's exit from NAFTA will cause serious economic shocks.

According to sources from Ottawa, the deal is very close, and there are still a few unresolved issues. Peter Navarro, the White House Trade Advisor, said earlier that all participants had worked in good faith and confirmed that a deal by the end of the day would most likely have.

How will this affect the markets and what do we trade in the minutes after the decision?

The oil deal will inevitably withdraw a large amount of capital from JPY's hedging positions, and European stock markets will first enjoy fresh capital.

Stock Market - After the main downside channel breakthrough, the CAC40 seems to be the most appropriate option for positioning with long positions, given the expected good outcome. Let's look at the H4 chart:

The price is in a short-term upward trend that has managed to overcome the main bearish diagonal formed by the end of May, so far. The price makes a comfortable adjustment that we can use for positioning with long positions the new trend and in line with the foundation. The price is located in a support zone formed by a local minimum, a medium-term downward diagonal (already drilled), a short ascending diagonal, and a 23.6% Fibonacci correction of the new upward movement. Price Action: In the last hours of trading last week the price forms a bullish pin bar in the support area - positive for the price. 50SMA crosses 200SMA from bottom to bottom - positive for price. However, DeMark's indicators give negative signals. DeMarker 14 is located in neutral zone and points down, and Sequential counts down 3 - negative for price.

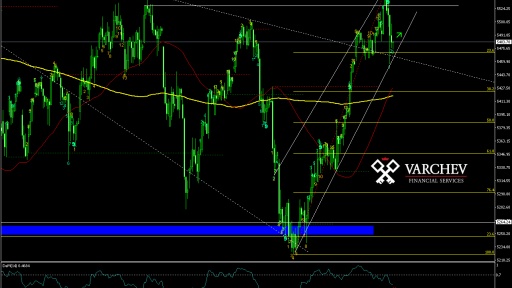

Futures of US indices look no less attractive. Let's look at the SP500 H4:

The price is on an upward trend and after an adjustment that gives good positioning with a long and objective test of the previous peak - All Time High for the index. Input from the current levels would be risky, so it's good to wait for a downward adjustment or adjust the volume to meet the maximum allowable loss. SL - under the local bottoms at a price of 2897.82.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.