- Home

- >

- Daily Accents

- >

- The new Wall Street machine for making money

The new Wall Street machine for making money

Populism finds a place on Wall Street

Nowadays it is difficult to find a tool with good profitability. The base interest rate was zero until four years after the end of the financial crisis, and even now, with interest rates rising, yields from defensive assets such as government securities are historically low. Investors looking for a strong return (those investing in a pension or the future of their children) are capable and willing to take on other options. The number of those who turn alternative assets is increasing and mostly debt-related.

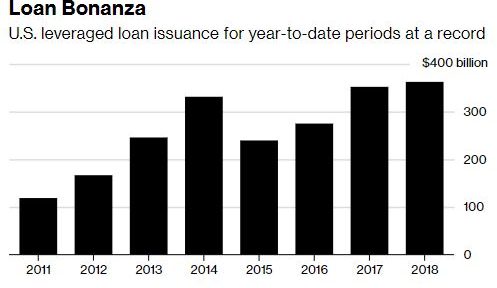

The graph below shows the amounts of lending to institutional investors.

Consider that this is a $ 1.3 trillion market that is becoming more and more popular for lending to venture companies. Private equity companies are often drawn to fund re-buy programs. Their investment horizon ranges from insurance companies to mutual funds and exchange-traded funds. In recent months, several Fed officials, including former chairman Janet Yellen, have raised concerns about the level of risk that accumulates in this market as money increases.

The federal agency's attempt to tighten credit scrutiny unleashed a shift in market participants from banks to less regulated creditors, including Jefferies, KKR & CO and Nomura Holdings.

Founded in 2015 by Mehere and two Wall Street developers, YieldStreet attracted investors who have invested more than half a billion dollars in exotic debt instruments. More than 80,000 people have signed up for suggestions from YieldStreet. Since this option has been put in place, investments have an expected return of almost 13%, and have not lost a portion of that percentage. In the same period, the S & P500 on an annual basis had an average return of 9.3%. With some investors who are eager to enter the new "money machine" and withdraw their profits, some assets offered by YieldStreet are liquidated in seconds.

For this phenomenon, the International Monetary Fund also share a negative view. Their April analysis finds that this market is significantly outperforming its levels of risk and that protectionism on investors is diminishing, noting that raising yields on new debt mechanisms, followed by tightening financial conditions or stopping the market to a maximum can lead to serious negative consequences for the real economy.

The group of financial regulators - including the leadership of the Fed, OCC, FDIC and FSEC - have not shared their warnings in their latest annual report. In fact, they mention that the high-risk loans that are granted are diminishing.

Yellen admits that the government is not doing enough, and that their hands are tied. "Dodd-Frank has not achieved much with its regulatory power to deal with it" - Janet Yellen.

Spurce: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.