- Home

- >

- Daily Accents

- >

- The new Wall Street obsession during the trade war

The new Wall Street obsession during the trade war

Following Monday’s market meltdown traders will take their cues from the Chinese central bank and where it sets the midpoint for the country’s currency, the yuan, as trade tensions between China and the U.S. increase.

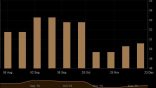

Every night at 9 p.m. ET, the People’s Bank of China fixes a level at which the yuan will trade against the dollar within China. The central bank last night set it at a stronger-than-expected level versus the greenback, helping U.S. stocks rebound on Tuesday from their worst day of the year.

On Sunday night in New York, however, the PBOC let the onshore yuan weaken to its lowest level against the greenback in more than 10 years, sparking fears of China weaponizing its currency in its trade war with the U.S. Those fears sent stocks tumbling across the board and moved the yuan to the top of a long list of variables investors are watching during the U.S.-China trade war.

“The new thing people will look at every night is see what the fixing of the yuan is at 9 p.m. ET,” said Keith Lerner, chief market strategist at SunTrust Private Wealth. “That’s going to drive sentiment from day to day along with headlines coming out of China. People are going to, no pun intended, be fixating on that combination every day.”

“The currency, on a short-term basis, will be a pivot factor in terms of what the market will watch for short-term direction,” said Gregory Faranello, head of U.S. rates at AmeriVet Securities.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.