- Home

- >

- Stocks Daily Forecasts

- >

- The options market indicates that it was known in advance that Xerox would bid HP

The options market indicates that it was known in advance that Xerox would bid HP

Hewlett-Packard shares jumped 17% in Wednesday's session after news broke that Xerox Holdings had made a merger offer to HP.

HP Bulls undoubtedly reaped great profits, but certain options traders "killed the market".

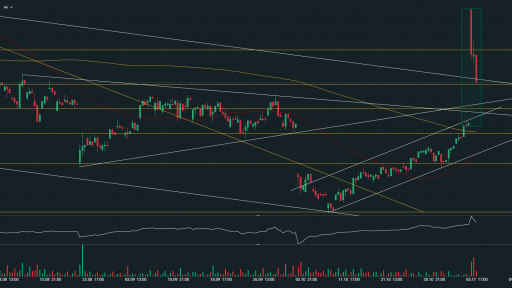

Unusual bullish call activity was detected as early as Tuesday afternoon (US time). The trader purchased 2,200 weekly HP call options that expire this Friday with a strike at $ 18.50 in a price range between 11 and 14 cents per contract.

Those options were closed on Tuesday at a price of 16 cents. Following news of a potential merger, the contract price jumped 1150% at the start of Wednesday's session, reaching $ 2 a contract. Given that the trader bought call options on Tuesday with a rough bet of $ 25,000, he or she theoretically made $ 300,000 on Wednesday morning (US time).

"It seems we have a situation where the news is likely to have leaked out in advance. This prompted the early purchase of weekly call options." says Jon Nakarian, an analyst at MarketRebellion. The jump in volumes also suggested that something strange was happening in the options market. Tuesday's volumes jumped to 10,400 contracts, the average volume for Tuesday, but last week it was only 4,400 contracts.

Stock-only traders also look at the options market, and watch it very closely to watch such unusual trades.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.