- Home

- >

- Daily Accents

- >

- The “Play – the – Pause” strategy works on Wall Street

The "Play - the - Pause" strategy works on Wall Street

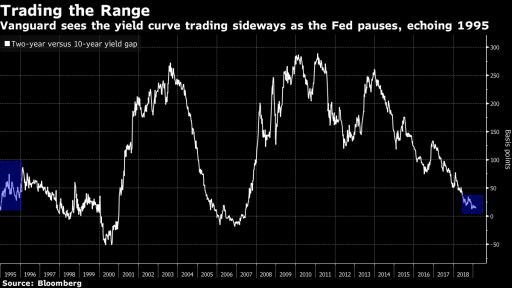

The change in FED's position towards dovish triggered the creation of a new wave of trading strategies and ways to capitalize on the Central Bank's "pause".

Gemma Wright - Casparius of the Vanguard Group expects changes in the yield curve on government securities in both directions, while Michael Kushma of Morgan Stanley Investment Management expects to increase carry trades and expand the portfolio of bonds. HSBC Holdings's Max Kettner says it is time for the funds to hold a neutral position while at the same time ready for aggressive positioning at a time.

Even if the volatility drops on stocks, bonds and currencies, investors still have enough opportunities. The veterans expect major sentiment changes, given the unseen decades of monetary policy uncertainty, as well as the ongoing geopolitical risks and commercial warfare. Although the change in the FED may lead to the disruption of some typical trends, many investors find new ways to make money. Those who can adapt - succeed.

The lack of subsequent tightening of monetary policy can bring bad news about the US dollar, according to Greg Gibbs, founder of Amplifying Global FX Capital. Especially if investor confidence improves on a global scale.

"A pause in the Fed's policy can support the recovery of other currencies around the world, rally in global stocks and lead to a weak dollar." - says Gibbs.

Some, like Jeffrey Snider, an economist at Alhambra Investments, say it's time to bet on what will happen after the break, given that the business cycle has already stretched enough. Recent analyzes show that the chances in the next two years can see a 25 basis point cut in interest rates.

"One way to trade this situation would be if we take long positions in any bond." - says Snider. "The futures market is now playing the probability of pruning interest rates."

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.