- Home

- >

- Cryptocurrencies / Algotrading

- >

- The quickening evolution of trading

The quickening evolution of trading

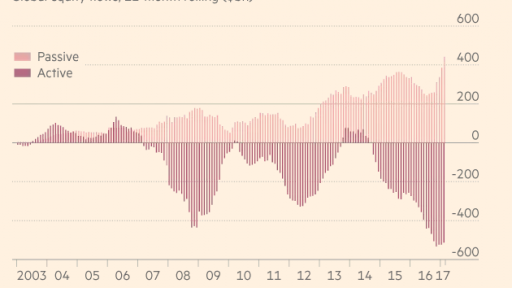

The evolution of financial markets is quickening thanks to the rise of automated trading algorithms, which range from the relatively simple, such as exchange traded funds, to artificial-intelligence powered hedge funds. Here is a selection of charts showing some aspects of how investing and markets have changed in recent years. The most apparent shift is in the world of investing, where traditional active managers have suffered big outflows in favour of cheaper, passive investment vehicles such as ETFs and index-tracking funds. Vanguard alone, with $4tn of assets under management, dwarfs the entire hedge fund industry. And as this chart from Citi shows, passive investment inflows are accelerating.

Here is another chart from Citi that shows the state of play. Passive funds now make up a big chunk of overall assets under management in Asian and US equities, and a smaller — but rising — proportion in areas such as US bonds.

In addition to the usual arguments for passive funds, such as their cheapness, Citi strategist Robert Buckland says that the “paradox of skill” means it is getting harder for fund managers to beat their benchmarks. He points out that the number of chartered financial analysts relative to the number of listed companies has exploded over the past two decades. “That’s a lot of well-trained buyside and sellside analysts for every stock. No wonder it’s got so tough to beat the market,” he says.

Things look a little brighter in the world of quantitative investing. The growing view that the future of active investing will not be human fund managers judging a company by the firmness of the chief executive’s handshake but computer scientists tinkering with trading algorithms has led to an explosion of job postings for financial engineers, while demand for more traditional analysts has stagnated, as this Bank of America Merrill Lynch chart shows.

The number of investment factors used by investment groups has swelled since the financial crisis, as financial scientists unearth more and more tradable signals from big data, such as credit card transactions, app downloads and even satellite imagery.

High-octane, algorithmic trading is also ascendant, with high-frequency trading volumes picking up from the post-crisis drop-off. Meanwhile, the volume of trading done by traditional active asset managers has flatlined, even as the share of trading done by passive investment vehicles has grown, as this Credit Suisse chart shows.

This is affecting the structure of the stock market, with the most actively traded stocks becoming even more liquid, while smaller stocks are becoming more expensive to trade. Flash crashes are becoming more common, with algorithms making, cancelling and adjusting quotes at a fast pace. Here is another Credit Suisse chart that shows how many quote changes are made per million of shares traded.

The rise of ETFs is also reshaping the trading day. Passive investment funds typically try to do most of their trading at the end of the day so that their holdings best match their benchmark, which has herded ever more trading activity in the last half-hour of the day, as this chart of the Russell 2000 small companies gauge shows. The pattern is what analysts call a “liquidity smile”.

It is important to remember that despite the roaring inflows into ETFs and quant funds, we are still only at the early stages of this investment revolution, with the vast majority of money still managed traditionally by human fund managers. There will undoubtedly be some potholes along the way, but markets are increasingly going to be shaped by machines rather than man.

source: Financial Times

Jr_Trader_A_Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.