- Home

- >

- Cryptocurrencies / Algotrading

- >

- The quiet Crypto market isn’t going unnoticed

The quiet Crypto market isn't going unnoticed

Cryptocurrencies, among the most volatile financial assets, lost much of their value, along with shares, bonds and commodities that had been under the "sword hold" for the entire month of October.

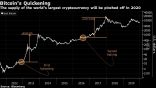

Bitcoin specially trades around $ 6500 in recent weeks, which contrasts with last year's manic rally and the steep slumber that followed this year. Enthusiasts are hoping for declining sharp movements in the cryptocurrencies to encourage businesses to step up their interest in using them to make transactions.

Since October 1, Bitcoin has moved 2% in just three days. By comparison, Bitcoin's average daily movements for 2017 were in the order of 5%. The recent movements in the crypto currency, however, contrasted with the movements of more traditional markets. For example, US stocks in October suffered most seriously for the past seven years. During this time, the bonds reached new historical peaks, many currencies from the emerging markets fell, while American crude oil entered the bear market.

Surprisingly, Bitcoin's volatility has dropped significantly, equaling the volatility of other classes of assets.

The 30 day volatility of the Crypto currency fell to its lowest point in December 2016. And at the S & P500, we are jumping to its highest value in March. These two measurements, which reflect how much the price has fluctuated in the last month, are now almost flat. According to some investors, this is due to the outflow of speculators. Bitcoin's average sales volume in October was 70% lower than most active days in December.

The 30 day volatility of the Crypto currency fell to its lowest point in December 2016. And at the S & P500, we are jumping to its highest value in March. These two measurements, which reflect how much the price has fluctuated in the last month, are now almost flat. According to some investors, this is due to the outflow of speculators. Bitcoin's average sales volume in October was 70% lower than most active days in December.

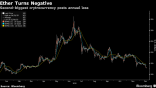

Competitors such as Ethereum, XRP and Bitcoin Cash remain stable. Since August, the market value of all the cryptocurrencies has remained above $ 200 billion. According to Morgan Stanley analysts, stability suggests that investors are expecting the next technological breakthrough that will make more people use crypto. This is a big problem for Bitcoin, who had a birth last month, marking 10 years of its birth.

Source: The Wall Street Journal

Graphs: The Wall Street Journal

Photo: Unsplash

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.