- Home

- >

- Daily Accents

- >

- The six catalysts that plunged the markets

The six catalysts that plunged the markets

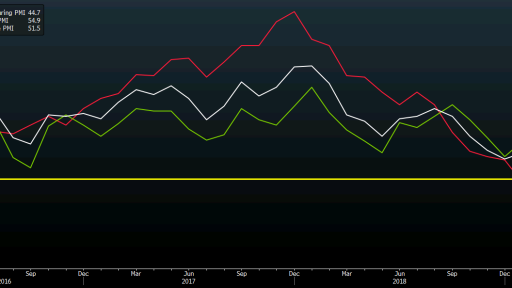

Undoubtedly, the markets were again overwhelmed by fears and worries, not just worse than expected PMI for Europe and the United States. Six key factors today have pushed the markets back to deep sell-offs, again shadowing prospects for economic growth.

The yield curve

The US 10-year bonds reached a bottom of 2.416% and a 3-month bottom of 2.410%. For the first time since 2007, we have seen a crossing between the two curves, and this has always been an early signal of coming economic problems.

Europe seems even worse

Today, Germany's PMI data for March went up to 44.7 and expectations were 48.0.

The last recession was driven by the United States, but if it is set for another, it will come from Europe and China where growth continues to look extremely risky and fragile.

Trump politicized the Federal Reserve

Today, several news came out that Trump has proposed Stephen Moore's work to the Fed. He is a political "footman" and a crude critic to Powell. This may not be over.

The deal with the Chinese is prolonging

There were no negative news from Lighthizers and Mnuchin, and the two returned to China for extra against. Markets, however, have already appreciated the high chances of a deal and it has not yet been confirmed. There are currently no signals that the agreement is coming soon.

Brexit never ends

The Pound has risen significantly today, but Brexit is still a complete mess. There was some optimism that May can convince everyone at the last minute, but the chances of this happening are getting smaller. We can hardly imagine its survival if the third vote is also lost, and if it comes out of the political arena, the political risks will rise immense.

Federal Reserve

There are two ways to interpret the dovish position of the FED. The first is that low interest rates are good for growth. This was yesterday's announcement to the markets. The second is that the Federalists know something we do not know. History tells us that the FED knows as much as any outsiders, but the market likes to "flirt" with this assumption in time.

Source: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.