- Home

- >

- Daily Accents

- >

- The Slowdown in Europe Should Give the Fed Pause

The Slowdown in Europe Should Give the Fed Pause

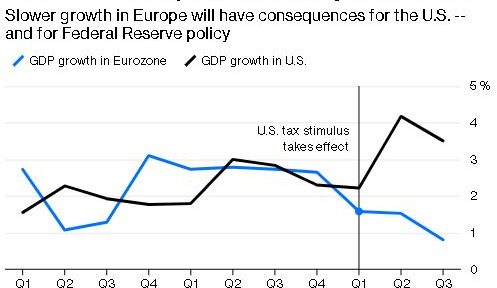

The Federal Reserve’s confidence in its policy of interest-rate hikes was undoubtedly bolstered by last week’s report of a strong U.S. economy. Look to Europe, however, and there are reasons to doubt that confidence.

Economic growth in the Euro area was just 0.2 percent in the third quarter, it was reported this week, half of what had been forecast and in stark contrast to the U.S. rate of 3.5 percent. This comes after a less dramatic but equally worrying decline in Chinese growth reported earlier this month. In both Europe and China, slowing international trade was cited as a key reason.

So far at least, stimulus from the tax bill passed last year has helped the U.S. avoid the slower growth infecting the rest of the world. After a slight pause in the first quarter, year-over-year growth in consumer spending has continued.

That stimulus, however, will fade in the coming year. If global growth continues to decline, there could be a repeat of the so-called shadow recession of 2016, when slow growth abroad caused a fall in the price of oil and agriculture products, leading to a sharp decrease in investment in the U.S.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.