- Home

- >

- Stocks Daily Forecasts

- >

- The S&P 500 has already met its average return for a full year

The S&P 500 has already met its average return for a full year

The average annualized total return for the S&P 500 index over the past 90 years is 9.8 percent. For 2017, in just under half a year, the S&P 500's total return is 9.7 percent.

Looking at these facts side by side, it might seem the market has been twice as generous as usual so far this year, tempting a wary investor to back away from stocks or expect next to nothing more over the coming six months.

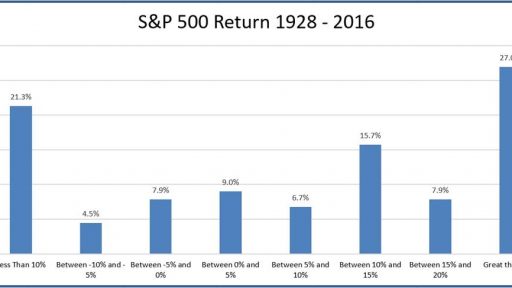

Looking now only at price returns (not counting dividends), a gain between five and 10 percent is one of the rarest results for stocks. According to data furnished by LPL Financial senior market strategist Ryan Detrick, in the 89 years from 1928 to 2016, only six finished with a gain in that range that we think of as a "typical" annual return.

So, if the historical odds are against stocks just idling near this level for the next several months, which way are they likely to go?

When the S&P 500 was up at least 7.5 percent on its hundredth trading day of a year, as it was this year, it added to those gains through year-end 20 out of 23 times.

And since 1950, when the S&P 500 has made at least 15 new all-time highs through May, it was far more likely to keep rising through December, and the average further gain over the final seven months was 7.7 percent, far better than the 4.5 percent average for June-December in all years

The largest and most significant exception to these patterns came in 1987 - a year that began with powerful upside momentum, faltered in mid-summer, then crashed in October to wipe out the early-year gains. It's a scary year to come up in the comparative analysis.

But it's also important to note the market was up a whopping 40 percent in the first seven months of that year - a ferocious blow-off rally. And stocks got very jumpy and started losing altitude badly in August.

Source: Bloomberg Pro Terminal

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.