- Home

- >

- Daily Accents

- >

- The stock market is worse than you think

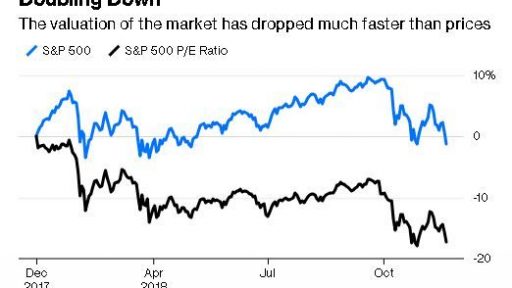

The stock market is worse than you think

Tuesday's Dow Jones Industrial Average fell 550 points as one of the worst days in history over the last decades. The price-to-earnings ratio for the S & P500 index based on the 12-month reports has dropped 17% this year.

While we observe close to market conditions in 2008, stock prices still show significant growth since Trump was elected president. But investors prefer to trade companies' shares according to reporting results (market assessment), which is a better indicator of their economic sentiment and outlines their opinion about Trump's policy rather than looking at current price levels stocks and draw conclusions from this. Rarely, their thoughts and preoccupations have changed so often, mostly driven by the growing trade war, the known signs of slowing growth rates in the global economy, and rising inflation and interest rates.

Keith Parker, a strategist at UBS, says the S & P500 will rise to $ 3,200 or by more than 20% by the end of 2019. It also points out that the higher consumer savings rate, the productivity gains of US companies, those who invest in the United States will lead to this increase next year.

But there are reasons to argue that the materialization of this rise will happen at all. While stock prices are falling, ratings are not really that low. For example, the P / E ratio has fallen to 12.8 at the end of 2008 before the market begins its recovery next year.

The bigger problem is that factors that generally lead to higher market ratings disappear. A strong labor market and commercial tariffs will likely drive up prices and corporate margins will shrink. Moreover, interest rates are also rising and growth slows down. These elements combined suggest lower market estimates rather than higher ones.

You are right if you say the markets are unstable and heavily shaken. The bad news is that things can get worse.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.