- Home

- >

- FX Daily Forecasts

- >

- The strength of the dollar will shift to a higher gear – it’s just the beginning

The strength of the dollar will shift to a higher gear - it's just the beginning

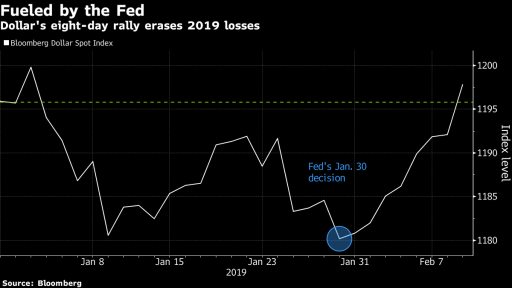

The incredible 8-day rally of the dollar can switch to a higher gear as central banks around the world are listening to the Fed's passive tone.

The greenback wins every day since the Fed meeting on January 30, when Bank President Jerome Powell said the chances of future interest rises have fallen. This change in the Fed stance, after forecasting at least two rises in December for 2019, has led central bankers around the world to lower their expectations of tightening global monetary policy - including the Reserve Bank of Australia and the Bank of England.

As a result, BNP Paribas's Asset Management changed its forecast for the dollar after experiencing a weakening of the greenback in 2019. They are now expecting a 5% increase for the first half of the year, as weakening global growth stops the other central banks from acting and reducing the gap between the economic conditions between them and the United States.

"The dollar is not weakening and the reason for this is that the Fed is just starting, which means that other central banks are likely to take more passive action," said Momtchil Pojarliev, head of currency group.

The greenback rose 0.5% on Monday to cover its losses for the past year and enjoys the longest winning series since January 2016. The surprise strength of the currency has also strengthened Wall Street's forecasts with companies like Morgan Stanley and Nomura initially bearish.

"The problem with the bear's dollar is that there is a chronic shortage of attractive currencies," said Kit Juckes, Global Fixed-Income Strategist at Societe Generale SA. "Lower yields on German bonds, not to mention even weak growth, political uncertainty and Brexit, are a good combination of factors not to like the euro as much as we like the dollar."

Source: Bloomberg Finance L.P.

Original Post: Panicking Doves Add Fuel to the Dollar's Longest Rally in 3 Years

Chart: Used with permission from Bloomberg Finance L.P.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.