- Home

- >

- Fundamental Analysis

- >

- The tale of Goldilocks is getting darker

The tale of Goldilocks is getting darker

The side effects of the trade war and cyclical economic weakness have become entangled in a rather distorted way, reflected in poor economic data, and the stalled US government has made tracking the largest economy in the world quite difficult.

The tale of Goldilocks on the market is beginning to wither, describing the current trajectory of the economy. We are entering a chapter of the story, which is much darker.

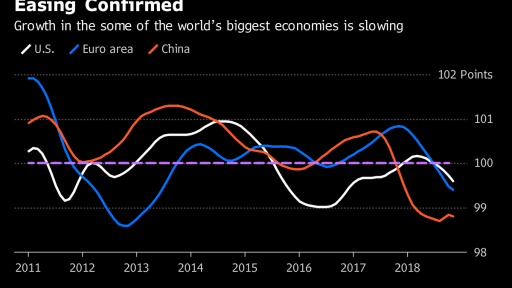

A very tough week for global growth, the only ray of hope coming from Italy, which is rather stagnant than in a recession. Everywhere else, the mood is pessimistic. The OECD points to a deep deterioration in the economic situation of countries around the world. In addition to bad commercial data, China also reflected the first dive of car sales in three decades. This only contributes to the slowdown in the economy, which has led the Chinese government to take tax relief to revive consumption. Germany has barely escaped a recession by the end of 2018, and Mario Draghi sees Europe cracked as much as it does not want to say the word starting with "P". Economic uncertainty is at high - record levels - globally. The worsened prospects of a quick resumption of the US government's work and a Brexit dispute resolution only increase the dark clouds on the horizon.

Esther George won this week's Dove Monetary Policy Prize, with the famed Hawkish Regional Governor of the FED calling for patience in terms of interest rates. This was the last sign that in 2019 the central banks would be careful. China quietly cuts down on loan costs while keeping interest rates unchanged. Japan's National Bank is likely to cut its forecast for inflation because of cheaper oil. Chaos around Brexit is likely to slow down the actions of the National Bank of Britain, and markets are now adjusting for the overall dovish mood. Turkey, Indonesia and South Africa are currently maintaining their interest rates.

China's trade negotiator will travel back to the US at the end of this month for the next round of negotiations, and in the meantime, world trade data does not look good. China's exports have taken a pretty sharp turn down at the start of the week, which only raises tensions over the prospect of a deal with the United States. Tensions are boosted even after the ongoing investigations against Huawei. In December, India has barely retained a good level of exports, and in Indonesia, exports have declined. Singapore has reported its worst export performance for more than two years.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.