- Home

- >

- Stocks Daily Forecasts

- >

- The Tesla bubble popped

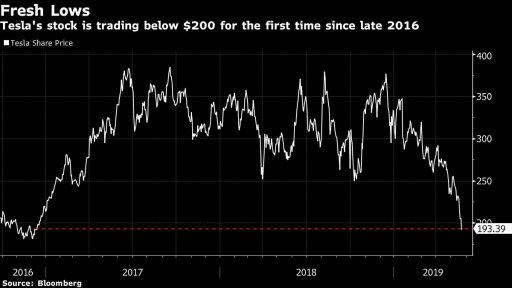

The Tesla bubble popped

The Wall Street blows to Elon Musk and Tesla have come one after the other in the last few days. A ruthless shot that shook company shares in such a way that analysts are already wondering if their value will recover at all.

Morgan Stanley made the biggest blow, declaring that in the worst case scenario, stocks could sink $ 10. Analysts at Wedbush have announced a "red-light" situation and cast doubt on Tesla's chances to sell enough electric cars to make a profit, and Citigroup and Robert W. Baird & Co. have cut their price target by noting their cash flow Tesla shares have been down by 43% or $ 23 billion in value since the beginning of the year, again shifting the company back, with market capitalization even narrower than General Motors and Ford.

That's why investors are panicked, but that may soon disappear. Tesla has become a popular company with its volatility. At the last state-trading session last week, the shares again reached $ 200, though it fell again to $ 190.63 after Musk announced that the company would achieve the expected results.

Only a year ago Morgan Stanley predicted that the stock would reach $379.

"Demand is at the heart of the problem," says Adam Jonas, JP analyst. The risks that distort the supply-to-supply balance are China.

Given the situation, there are many believers who believe the company will find the "engineering" solution to address the problem.

Whatever the history of bears and bulls, the price ranges currently range from $ 54 to $ 530. This means that the company will still be ahead of its competitors.

"Electric cars may be the future of transport, but I do not think Tesla will take advantage of the profits" says Bradford Meikle, senior analyst at Williams Trading.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.