- Home

- >

- Daily Accents

- >

- The weakness of the US dollar is forthcoming. But is it so?

The weakness of the US dollar is forthcoming. But is it so?

A familiar mood sneaks into FOREX markets: The dollar will sink next year.

This idea is somewhat reinforced and supported by the fall of the Bloomberg Dollar Spot Index by about 0.8% after market participants have assimilated news after the Fed meeting.

But the belief in the American economy and the fact that so many people expect "green money" to fall cheaper is enough to convince a large enough mass of people to bet on its appreciation.

Ed Al Hussainy, a currency strategist at Columbia Threadneedle Investments, says that looking at the forecasts coming from sellers, 80-85% of them think he's going to take it down. And if we look at the previous experience, usually when all forecasts point in one direction, the currency does not move exactly according to the plans.

The scenario for the final bearish grip will be as follows: The US economy can not catch up with the rest of the improving economies. Growth in the economy will be close to that of the rest of the world, and the Fed will stop or lower the rate of interest rate hikes and the advantage of investors holding dollars will decline.

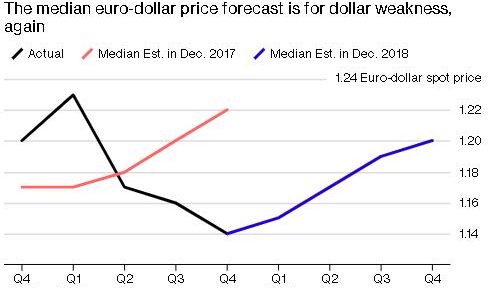

However, the convergence scenario with the world economy sounds familiar to those who have seen it in previous analyzes and forecasts. At this time last year, a forecast by Bloomberg showed that green money would fall against the euro to $ 1.21 from $ 1.18. Instead, the dollar gained momentum and the exchange rate reached $ 1.14.

The Bloomberg Dollar Spot Index was up 3.6% for the year. The exact disputed for the weak dollar in 2018 will send it as the winners, and now we are again watching strategists seeking to break the status quo. There are analysts who say the dollar will continue its rally in 2019.

Although the Fed's prospect for 2019 is misty, some analysts expect to raise interest rates several times, but others say they will not do so once. This, however, contrasts with the dovish mood of most central banks around the world. We will hardly see a rapid and rapid narrowing of interest rates between the US and the rest of the world.

Still, in the media, we can find a number of statements pointing to "green money" losing out of its strength for next year, but the market is beginning to adjust to contradict the allegations. Wall Street's worst deal is: long USD. Recent CFTC reports also show that long positions for the dollar are at record levels.

The dollar is still quite strong, although the good news that supports it will start to diminish. We are close to the end of the current FED interest cycle. Risks are being accumulated that would threaten long-term traders and investors with the US dollar.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.