- Home

- >

- Fundamental Analysis

- >

- The worst for the global economy might be history already

The worst for the global economy might be history already

The world economy may be the rockiest since the financial crisis, but there is reason to expect that the current slowdown will be short-lived.

Bloomberg Economics, Deutsche Bank AG and Morgan Stanley are among those whose economists expect the slowdown will reach its bottom during this quarter or the next, and expect acceleration later this year.

"Put the Federal Reserve's interest rate pause, the trade agreement and the stimulus in China together, and we can look for a breakthrough in the first quarter and very moderate progress in the future," said Tom Orlik, chief economist at Bloomberg Economics.

Central banks:

Led by the Fed, many central banks either hindered the tightening of monetary policy or introduced new stimulus, reassuring investors' fears of slowing down. Fed chairman Jerome Powell says he and his colleagues will be patient to raise interest rates again, while European Central Bank President Mario Draghi won't have the chance to rise rates this year and opened a new batch of cheap credit for banks.

Bankers in Australia, Canada and the UK are among those who have adopted a "wait and see" approach. China, at its National People's Congress this month, signals readiness to ease monetary and fiscal policies to support economic development.

Easy Money:

After the tightening of monetary policy at the end of last year, partly urging the FED to rethink the prospect, the financial conditions has eased. After reaching the lowest level of a twenty-one-year low in December, the Bloomberg Financial Condition Index, which measures the overall level of financial stress on the money, bond and equity markets, has since recovered.

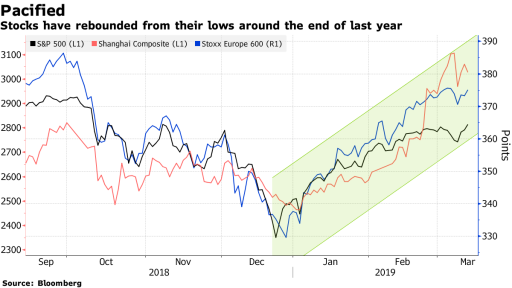

Reflecting the more positive opinion of investors, this year there was an increase in stock markets. The S & P 500 jumped nearly 20% from its level in December, while Shanghai Composite grew by about 22%.

The weakening of the US dollar by 2018 also gave relief to emerging markets. This, on the other hand, supported the price of the goods, and we saw a sharp increase in the price of oil from the beginning of 2019. The number of loans to China and Japan in February marked a sharp rise from a year ago.

Data from Europe:

Europe also took part in surprises for 2019, with economic data from the alliance starting surprisingly better than expected. Although European banks have had a serious exposure to Turkey, Brexit, Italy and the yellow vests, analysts still do not expect a recession, and they are expecting an improvement in the economy by the end of 2019, despite the current slowdown. This was also the idea of ECB activating additional incentives for banks in the form of TLTRO.

Labor market:

Even with the February disappointing US employment report, the global labor market is still stable, which gives reason to hope that consumers will continue to spend money and that consumer confidence stays at stable levels. JPMorgan Chase & Co. estimates the unemployment rate in developed countries at the current 40-year low of 5% and continues to fall. The bank predicts that wages will rise by 3.2% in the last quarter of this year, the fastest one at every single point in the decade, and is almost one percent faster than the same period in 2017.

In conclusion, despite the many media negatives and the apparent slowdown in the end of 2019, recession and a new financial crisis are unlikely to occur by the end of 2020. Investors' expectations are already seriously seen in the charts, and obviously central bankers will postpone the "end of the world" .

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.