- Home

- >

- Daily Accents

- >

- These Assets Would Benefit From a Weaker Dollar

These Assets Would Benefit From a Weaker Dollar

Precious Metals

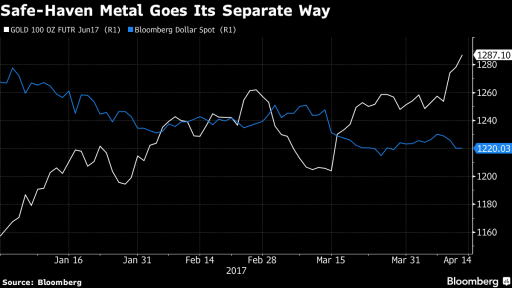

The U.S. dollar still rules as the most important currency in the world’s markets, which has in recent history created an inverse relationship between gold and the greenback. Declines in the dollar create demand for the safe haven.

While the Bloomberg Dollar Spot Index slumped 0.8 percent in the holiday-shorted week, gold rose 2.3 percent to trade at its highest since November.

Crude Oil

Consumers might end up seeing a higher bill at the gas pump if Trump gets his wish for a weaker dollar.

“Typically, the U.S. dollar and commodities move inversely, hence should President Trump’s comments have their desired effect, he will inadvertently be encouraging a rally in oil prices -- ergo, gasoline prices -- as well as other commodities,’’ Matt Smith, director of commodity research at ClipperData LLC said in an interview.

U.S. Exporters

The more that a company sells overseas, the more impact it can see from changes to currency valuations. For example, Apple Inc. does a great deal of sales internationally, and has publicly lamented headwinds from a strong dollar.

“Since June of 2014, so we’re talking about 2.5 years ago, the dollar has strengthened 25 percent against the basket of currencies where we do business,” Luca Maestri, Apple’s chief financial officer, said at a conference in February. “We always want to find the optimal balance between units, revenue, and margin, and it becomes more difficult as the dollar appreciates.”

Corporate Credit

Credit markets also benefit from a weak dollar that stimulates foreign investments.

Emerging Markets

Emerging markets are another beneficiary of Trump’s weak-dollar posture, with the offshore yuan jumping after the comments. The president’s expression of support for low interest rates also buoyed the currency. A stable greenback would help China’s central bank keep the yuan stable, protect the economy from looming capital outflows

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.