- Home

- >

- Daily Accents

- >

- They’re The Fastest Traders, So Why Aren’t They Thriving?

They’re The Fastest Traders, So Why Aren’t They Thriving?

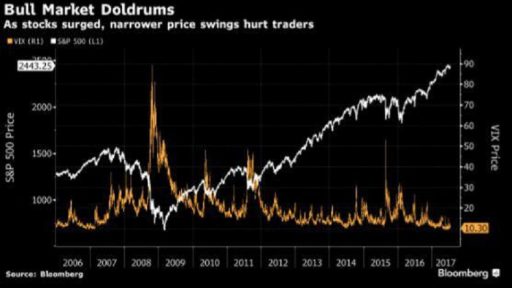

High-speed traders have hit the wall. Even as critics of high-frequency firms have argued their speed and technology give them an unfair advantage, the traders are facing diminishing returns. For one thing, there’s been relatively little turbulence in this bull market, a challenge for high-frequency traders and other market makers because it restrains volatility and trading volume, curbing their profits.

That’s created an identity crisis for the fastest traders, forcing companies like Virtu Financial Inc. to seek out new businesses and pushing others out entirely. One stat helps boil it all down: Market makers in U.S. stocks produced $1.1 billion in revenue last year, compared with $7.2 billion in 2009, according to estimates from Tabb Group LLC.

Virtu, a New York-based firm that trades more than 12,000 securities and other financial instruments on over 235 markets around the world.

Virtu Chief Executive Officer Doug Cifu and Bob Greifeld, Nasdaq Inc.’s former CEO who will become Virtu’s chairman after the KCG deal closes, see potential for the company to build a larger business selling trading technology.

Profit at Virtu has come down from its peak, with net income dropping to $158 million last year from $197 million in 2015. Its shares trade below the company’s initial public offering price of $19. Virtu fell 0.3 percent to $16.80.

High-frequency traders use advanced technology and a deep understanding of the electronic marketplace to carry out or cancel trades.

“They don’t want to see a flash crash kind of day, they want just enough of things happening so that people change their minds and want to trade.”

“High-frequency traders will move into areas they weren’t in before,” said Ari Rubenstein, co-founder of Global Trading Systems LLC.

The degree of the market’s doldrums is striking. The CBOE Volatility Index — better known as the VIX — sank to a 23-year low on June 2, showing investors see continued calm.

Teza Technologies LLC shifted away from trading to focus on its hedge fund, selling some technology assets to Quantlab Financial LLC.

Interactive Brokers Group Inc., a broker that helped invent electronic trading, sold its options market-making business

Chopper Trading LLC, a Chicago-based speed trader, sold assets to DRW Holdings LLC in 2015.

Source: Bloomberg

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.