- Home

- >

- Stocks Daily Forecasts

- >

- This reliable indicator says we’re in a bear market for stocks

This reliable indicator says we’re in a bear market for stocks

One of the darkest clouds on Wall Street’s horizon is declining margin debt.

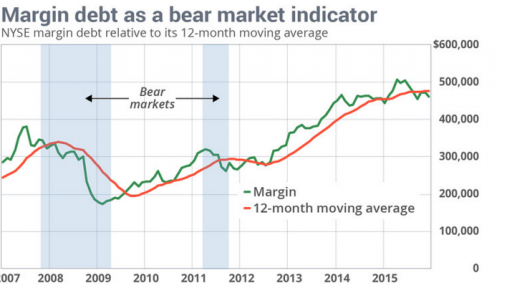

I’m referring to the total amount investors borrow to purchase stocks, which historically has risen during bull markets and fallen during bear markets. And that’s what is so ominous: The New York Stock Exchange reports that total margin debt hit its peak last April, and is now nearly 10% lower, as you can see from the chart above. (Note that the latest data is from December; January’s total will undoubtedly be lower.)

In fact, according to research conducted by Norman Fosback, the former president of the Institute for Econometric Research and current editor of Fosback’s Fund Forecaster, a good long-term indicator can be created by comparing total margin debt with its 12-month moving average. “If the current level of margin debt is above the 12-month average, the series is deemed to be in an uptrend, margin traders are buying, and stock prices should continue upwards,” Fosback wrote in his investment textbook “Stock Market Logic.”

“By the same line of reasoning, sell signals are rendered when the current monthly reading is below the 12-month average. This is evidence of stock liquidation by margin traders, a phenomenon which usually spurs prices downward.”

Fosback introduced this indicator to clients in the mid-1970s, based on research extending back to 1942. He calculated that there is an 85% probability that a bull market is in progress when the indicator is bullish, in contrast to only a 41% probability when the indicator is bearish.

This indicator acquitted itself well in the 2007-2009 bear market: Total margin debt hit its peak in July 2007, three months prior to the bull market peak that year (which occurred Oct. 9). And it dropped below its 12-month moving average in December of that year, and stayed below until the summer of 2009, early in the bull market that began in March of that year.

The indicator didn’t do quite as well during the 2011 bear market, which according to the calendar compiled by Ned Davis Research, lasted from April 29 through Oct. 4. Though total margin debt that year did indeed hit its high in April, it didn’t drop below its 12-month moving average until August.

It’s also important to acknowledge that the indicator sometimes sounds false alarms. One such time came in January of last year, when total margin debt briefly dipped below its 12-month moving average before quickly climbing back on top. Even so, however, the indicator might not be considered a total failure, since the broad stock market today is 10% lower than where it stood when I announced the bear market signal in an early-March column.

In any case, unlike the early-2015 dip below the 12-month moving average that lasted for just one month, margin debt currently has been below its trend line for five straight months. It therefore is sounding a strong alarm today.

MarketWatch

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.