- Home

- >

- Great Traders

- >

- Show me the money

Show me the money

Stop complaining about how lousy the stock market was this year. It was great—to the tune of $60 billion—for titans in the right industries.

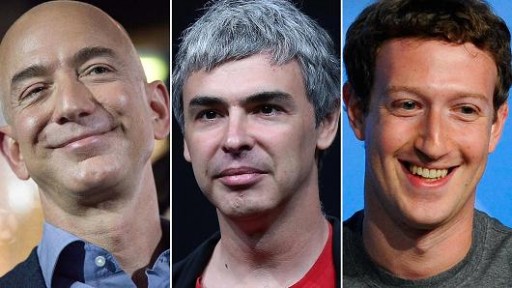

Eight CEOs of companies in the Russell 1000 index, including Jeff Bezos of online retailer Amazon.com (AMZN), Mark Zuckerberg of social media giant Facebook (FB) and Larry Page of online advertising firm Alphabet (GOOGL), generated a massive $60 billion score this year from their stock holdings.

The biggest winner—by far—was Bezos. The CEO of Amazon.com, a retailer using technology to upend the entire industry, scored a massive $32 billion haul this year. That's right - just one CEO claimed more than half of the total score hauled in by these eight top-winning CEOs. But that's what happens when you have a CEO, who owns 18% of a company that's now worth $325 billion after a 124% rise of the stock this year.

Another huge winner is a CEO who is almost half's Bezos' age: Mark Zuckerberg of Facebook. Zuckerberg, 31, scored $12.5 billion in wealth this year thanks to the stock's 38% increase. Zuckerberg, who owns 15% of Facebook, continues to be the single-most largest owner of Facebook stock.

Alphabet, the company formerly known as Google, had an even better year than Facebook in terms of stock-price performance with a 50% rise. The year's stock-price rise translated into a nice $11.7 billion gain for CEO Page. Don't feel too bad for Page, though, as he trailed Zuckerberg's take stock-market take. Keep in mind Alphabet co-founder Sergey Brin, while not a CEO, also owns more than 42 million shares of the company's stock. That means Brin, president of Alphabet, himself scored $11.1 billion. That brings the year-to-date stock gains of the two "Google guys" to nearly $23 billion.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.