- Home

- >

- Great Traders

- >

- Three arguments from old school signaling bear markets

Three arguments from old school signaling bear markets

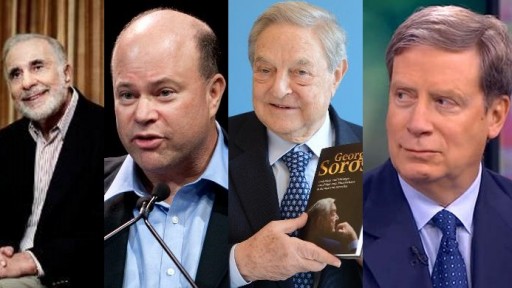

It is good to know what the mood of some of the most respected hedge fund managers, given that they have made billions of dollars in the markets. Except for the mega bulls current levels make many investors of the old school to be cautious, even bearish. Here are three arguments of respected legends like Carl Icahn, George Soros, Stanley Druckenmiller, David Tepper and others for this:

1. Aging bull market

We know all bull markets have a definitive beginning and a definitive end. The only problem is that we don’t know when the beginning or end will occur. We only know it for certain after it happens which makes it a rear view mirror phenomenon. That said, this is an aging bull market for equities anyway you slice it. The bull market is 7.5 years old (since the March 2009 low) and the major U.S. indices have largely moved sideways since QE 3 ended in October 2014. The last few bull markets ended shortly after their 5th anniversary, which means this one is definitely up there.

2. Earnings recession

We are in an earnings recession. Typically, investors love earnings and they like paying up for earnings growth. We are seeing the exact opposite, even with all the easy money from global central banks, earnings continue to fall. We just finished the second quarter and so far all evidence suggests another lousy quarter for corporate earnings. My friends at FactSet estimate earnings will decline -5.3% for the S&P 500. If earnings actually decline for Q2 it will mark the first time the S&P 500 has reported five consecutive quarters of year-over-year declines since Q3 2008 through Q3 2009. So far, 81 companies have issued negative EPS guidance and only 32 have issued positive EPS guidance. Hardly, anything to write home about.

3. Stocks are not cheap

Another big element investors look for are attractive valuations. Historically, bull markets top out when the P/E ratio for the S&P 500 gets into the low 20′s. Right now the forward 12-month P/E ratio is 16.4 which is considered by most to be “fair” value. Meaning, stocks are not cheap and they are not expensive. It is also important to note that we are slightly above the 5 year average of 14.6 and above the 10-year average of 14.3.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.