- Home

- >

- FX Daily Forecasts

- >

- Three scenarios for the pound after the December 12 election

Three scenarios for the pound after the December 12 election

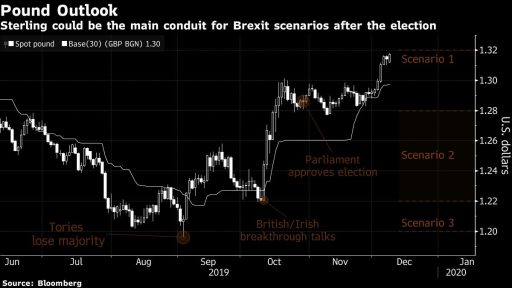

The British pound rally is expected to remain limited regardless if Boris Johnson wins the majority during the election and even manages to push Brexit before January 31st. This is expected, as time goes on for a trade agreement during the transit period ending in 2020. Any long-term uncertainty surrounding the economy and Brexit will increase BoE's chances of reducing interest rates next year, which will weigh more on the currency.

In the first option: Conservative majority: BJ gets more than 325 seats in parliament. Here the pound against the US dollar will hardly go above 1.32 and the EUR / GBP below 0.83. The British Gilt will be sold initially, with the yield on 10-year bonds to remain around 0.9%.

Short-term increases in the pound will weigh above the FTSE 100, which is highly dependent on exports, but the trajectory of the index is also shaped by raw materials and negotiations between the US and China. Smaller, local businesses may be among the most profitable.

However, the initial reaction may be quickly counterbalanced by the likelihood of a no-deal Brexit given concerns that the EU and the UK may not reach a trade agreement. Pound options estimate the risk of the price going down to 1.2815, with a 68% accuracy rate. This is also likely to happen if the Torit win by a small majority. The added weight of Brexit risks will send the price of the pound in the range 1.24 - 1.28.

Rate cut chances will continue to be estimated at 50% in 2020.

The second scenario involves a situation where the situation is little or no change. The Tory people cannot reach the majority, and the parliament remains inactive again. The consequences will aggravate political and economic uncertainty and will significantly reduce the chances of the Brexit agreement to pass.

In these circumstances, the market expects the pound to fall quickly to the range of 1.22 - 1.28 before we even have a pact to leave the EU. The options market shows cable values at 1.25 levels. In the short term, bond yields will collapse and traders will appreciate the rate cut as early as January, especially if the Phase I Deal is not concluded by the US and China.

The rally is expected to hit, with 10- and 30-year bonds intersecting, inflation rising, with five years expected to jump to 3%. Companies and shares in the construction business, banks and real estate, respectively, will suffer the biggest losses.

Third option ... Corbyn as Prime Minister.

As a result of the election, the Conservatives win less than 300 seats, and Labor also loses positions. Although Labor can manage to form a government with the support of other parties, one of the conditions of the coalition could be Corbyn becoming PM.

In this case, the government will seek an additional Brexit extension to call a second referendum. This is the worst case scenario, with investors expecting the government could nationalize everything from railroads to telecommunications companies. Ambitious government spending plans will boost the pounds, as well as increase bond yields.

The cable will test the 2019 bottoms at 1.22, backed by options. In the worst case, it will drop to 1.20. The rate cut by BoE is expected to occur in early 2020. Due to concerns about nationalization, shares of companies such as Royal Mail will collapse.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.