- Home

- >

- Stocks Daily Forecasts

- >

- Today marks the start of the financial reports in the bank sector: JPMorgan Chase, Citigroup and Wells Fargo

Today marks the start of the financial reports in the bank sector: JPMorgan Chase, Citigroup and Wells Fargo

A historic rally in US bank shares has fizzled out in recent weeks as hopes have faded that Donald Trump’s election will give a big boost to the industry’s profits.

Yet first-quarter earnings due for release in the next few days give executives a chance to show they are already benefiting from a more bank-friendly environment, even if lighter regulation and lower taxes have yet to materialise.

Three of the four biggest US banks by assets — JPMorgan Chase, Citigroup and Wells Fargo — are due to publish results on Thursday. JPMorgan and Citi are expected to deliver respective year-on-year rises in net income of 9 per cent and 4 per cent, but Wells is forecast to post a 4 per cent decline as it tries to recover from a scandal over sham accounts.

But investors will be looking for firmer answers from executives on what has caused the slowdown — and, perhaps more importantly, whether and when things will pick up.

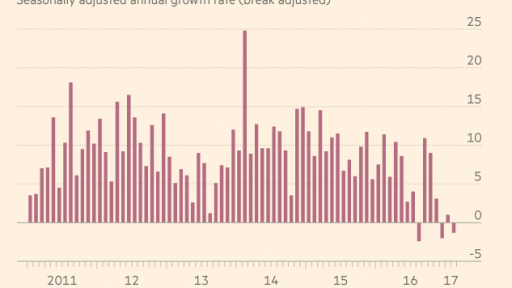

Lenders make money by charging borrowers higher interest rates than they pay out to savers. Since the financial crisis, however, this all-important margin has been squeezed. The Fed’s easy-money policies have reduced banks’ deposit costs but at the same time cut by even more the amount they can earn from borrowers. As a result, the so-called net interest margin for US banks (NIM) hit a 60-year low about a year ago.

Financial markets expect further NIM improvement over the first three months of 2017 to compensate for the lending slowdown. Goldman Sachs forecasts an 8 basis point rise.

But investors will be paying close attention to the size of the benefit at individual banks, which depends on the proportion of their loans that have fixed interest rates, among other factors. Among the biggest expected beneficiaries is Bank of America. Analysts at Jefferies forecast its net interest income will rise 6 per cent from the previous quarter to $11.2bn, in large part because of the NIM improvement.

Source: Financial Times

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.