- Home

- >

- Daily Accents

- >

- Top 4 Things to Know in the Market on Tuesday

Top 4 Things to Know in the Market on Tuesday

1.Stocks set for weak opening

U.S. stock markets are set to open lower again as fears grow that there will be no trade deal between the U.S. and China to stop the latest round of U.S. tariffs coming into force on Sunday.

Dow futures were down 149 points or 0.5%, while S&P 500 futures were also down 0.5% and Nasdaq 100 futures were down 0.6%.

Overnight, Asian markets traded mixed, with most trending lower, while European markets – always highly exposed to trade dynamics – fell more sharply. The Euro Stoxx 50 lost 0.8% while the German DAX was down 1.2%.

Autozone leads a minimal earnings roster for the day.

2. Democrats set to announce Articles of Impeachment

The House of Representatives is expected to file at least two articles of impeachment in its effort to remove President Donald Trump from office, according to various reports.

The articles, one alleging abuse of office and the other alleging obstruction of Congress, are set to be announced at a news conference in Washington.

3. U.S. swipes at Chinese transportation sector

With radio silence on the trade front as the clock ticks down to the Dec. 15 deadline on more U.S. tariffs, the U.S. and Chinese governments continue to snipe at each other through sector-specific measures aimed at cutting each other out of their respective markets.

The U.S. is drafting a bill that would stop federal agencies buying railcars and buses made by Chinese companies, two of which have invested heavily in U.S. production facilities in recent year, according to The Wall Street Journal. The National Defense Authorization Act would exclude railway giant CRRC and electric vehicle maker BYD from federal contracts.

The move follows a Chinese order at the weekend to remove all U.S. computers and software from Chinese government offices and agencies.

4. Japanese, Chinese, German data point to global weakness in Q4

The world economy looks in dicey shape going into the fourth quarter, with data from Japan and China overnight both painting a gloomy picture. Producer price inflation in China ticked up in November but was still -1.4% on the year. Consumer prices looked close to peaking after a surge in pork prices abated.

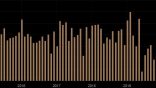

Machine tool orders in Japan fell at their fastest rate since the 2009 recession in October, down 37.9% on the year. The data, follow a similar, if gentler, drop in German factory orders for October last week, and point to sustained weakness in global business investment, given that both economies are heavily exposed to trade in capital goods.

Separately, the German Mechanical Engineering Association said its members don’t expect production to pick up before the second half of next year. The German ZEW survey, by contrast, painted a more optimistic picture, its economic sentiment index hit the highest level since February 2018.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.