- Home

- >

- Daily Accents

- >

- Top 5 things – “Playbook” for the week

Top 5 things - "Playbook" for the week

Although trade and its effects on financial markets are likely to remain at the forefront of this week, market participants will look ahead to the latest US employment report, monetary policy updates from a number of central banks, including the European Central Bank and the state visit to Donald Trump in the UK.

1. Trade War

Trump has announced surprisingly new tariffs for Mexico on Friday, and $ 200 billion Chinese import tariffs have risen on Saturday to 25% from 10%. As the tensions in world trade war show no signs of relieving investors, they fear that the world economy is approaching a recession.

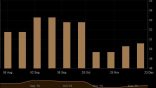

Bond markets are beginning to warn with three-month earnings in the US, which are already over 10-year-old, the so-called inversion of the yield curve, which predicts most US recessions in the 20th century. May was the first month in red since the beginning of the year for the world and US stocks.

The intensification of the trade war may have fueled the Federal Reserve's hesitation to respond to the tensions in world trade. Currently, the financial markets are pricing with a fall in the FFC price for two quarters before the end of the year.

Fed representatives hold a two-day conference in Chicago this week to discuss how they set monetary policy but the focus on how best to perform the mandate of stable inflation and full employment is likely to be overshadowed by short-term requirements to combat the impact of trade war.

2. Employment data in the United States

On Friday, the Nonfarm Payrolls report will also be published in the US for May following a recent batch of mixed economic data. The consensus forecast is that the economy has added 183,000 jobs and the unemployment rate stable - 3.6%.

Other important economic calendar data include the PMI index, the factory orders on Tuesday, the Fed's Beige Book and ADP on Wednesday, and a trade balance report on Thursday.

3. Draghi to support the economy

European Central Bank President Mario Draghi will give the eurozone economy a little support on Thursday in the form of generous loans to banks so they continue to lend to the business while leaving the door open for even greater incentives.

The outlook for the eurozone economy has faded. World trade war shows no signs of distraction, Italy is again in conflict with the European Commission, German industry continues to reflect grim numbers, stocks collapse, inflation expectations are diminishing, and the threat of hard Brexit rises.

But first-quarter growth grew significantly above expectations and bank lending continued to increase, indicating that any revisions to the ECB's economic forecasts would likely remain modest.

"We think the Governing Board may sound more tempting than these (projections) would be reasonable," Morgan Stanley said. "This is partly due to the fact that downside rather than economic risks are political in nature - from trade policy to domestic politics and geopolitics."

4. The visit of Trump in the UK

Trump said Britain must refuse to pay the 39 billionth divorce bill to the European Union and "leave" Brexit's talks if Brussels does not give the UK what it wants.

Trump will be welcomed to Queen Elizabeth II and will meet with Prime Minister Theresa May. During his visit to the United Kingdom, widespread protests were planned.

Trump reiterated his support for candidates who will be fighting for May, who said Britain should leave October 31 with or without a deal.

5. RBA to lower interest rates

Australia is expected to become the second most advanced economy to start lowering interest rates this week. Australia's central reserve bank is expected to cut interest rates by a quarter of its percentage point to a record low of 1.25% after its Tuesday meeting, which will be its first three-year cut.

"We will be very surprised if the RBA does not begin the process of easing the June 4 meeting. The markets are certainly ready for it, with Bloomberg showing the likely market probability of a 87.2% decline in this deal, "ING said.

"Until August, markets suggest a 50% probability of further decline. We agree. Until then, the RBA will receive more data on inflation and additional labor market information. "

Meanwhile, India's reserve bank is also expected to cut interest rates at its Thursday meeting by cutting the redemption rate to 5.75% from 6%.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.