- Home

- >

- Daily Accents

- >

- Top events to watch out for today

Top events to watch out for today

Apple will release fiscal results for the third quarter today after the end of the US session, closing the corporate season curtains for major technology companies.

Apple (NASDAQ: AAPL) is expected to report earnings of $ 2.09 per share on revenue of $ 53.3 billion, down $ 2.34 from revenue of $ 53.3 billion a year ago.

In addition to the usual revenue and guidance, the Apple services segment - iCloud, Apple Music and the App Store, among other applications, will be closely monitored as the tech giant seeks to reduce its dependency on iPhone sales, which make up about 60% of total income.

Goldman Sachs, citing Sensor Tower data, issued a warning about revenue from iPhone maker services amid signs of slowing App-Store growth.

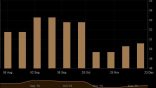

"In terms of revenue, the Sensor Tower shows iOS App Store revenue growth of 14% Y / Y in June from 18% year-on-year in May, 21% in April and 22% in March," Goldman said.

Meanwhile, Advanced Micro Devices is also reporting profits after the closing bell on Tuesday.

AMD is expected to report earnings of 8 cents per share, with revenue of $ 1.52 billion. This will be a decrease from the results of 14 cents per share on revenues of $ 1.76 billion a year ago. The chipmaker's guidelines will also be closely monitored, with investors eagerly trying to understand whether the company continues to follow the guidance of high single-digit growth from year to year.

Merck, Pfizer, and Procter & Gamble are other notable names to report profits before the markets open.

Consumer health, the foundation of the recent strength seen in the US economy, will be the focus once again with consumer confidence and their costs remaining the focus of the calendar today.

It is expected that personal income will slow down to 0.3% from 0.5% in the previous month, while personal expenses will also slow down by 0.3% from 0.4%.

Consumer confidence is expected to jump to 125 in July from 121.5.

Housing will also attract attention, with the National Association of Brokers expected to issue its monthly measure of pending home sales.

The data from the American Petroleum Institute, which will be presented today, will give traders an early look at whether US shipments will continue with their 6-week drop.

API reported last week that domestic crude oil supplies fell by 10.961 million barrels.

The data comes as investors await trade talks between the US and China, which will resume in Shanghai this week, with analysts warning that oil prices could fall in the coming weeks if negotiations fail.

"Even with Iran's escalating activity in the Hormuz Strait and the large draw on US oil reserves, oil markets have not been able to rise higher, suggesting that a further decline may follow in the coming weeks," the oil analyst said. GasBuddy Patrick DeHaan.

"There are still concerns about the lack of a China / US trade agreement," he added.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.