- Home

- >

- Daily Accents

- >

- Traders are gearing up for Trump’s tax cut plan

Traders are gearing up for Trump's tax cut plan

Months after the so-called "Trump trade" fizzled, traders are once again being enticed by the possibility of a pro-business policy overhaul — and piling into the areas of the market that could benefit the most from the new president's plans.

The latest trigger is a tax proposal that's set to be released on September 25 — one that's expected to reveal specifics around a lowering of the corporate tax rate, as well as a one-time repatriation tax holiday for companies holding trillions of dollars overseas.

The renewed willingness to trade on this is a big change of sentiment for investors. After pumping up stock prices on the hopes that Trump and a Republican legislature would push through tax cuts and infrastructure spending to boost economic growth and fill corporate coffers, they were eventually worn out as the promises repeatedly failed to materialize.

Once able to create or erase billions of dollars of market value with a single tweet, the president's influence looked to be waning.

The companies paying the most taxes

Since 2015, Trump has been adamant about cutting the federal corporate tax rate from its current 35% to 15%. While he doesn't appear to have much support from his fellow Republicans, who have called a decrease all the way to 15% unworkable, there's no denying that investors are feeling increasingly confident about the most highly-taxed companies, which would benefit most from such a measure.

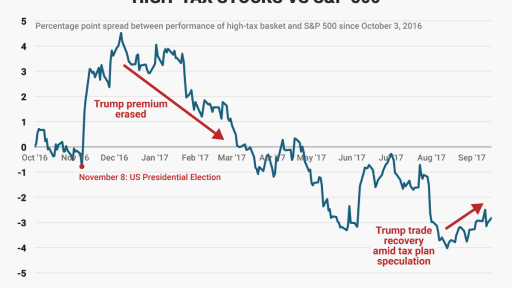

As indicated by the chart below, a Goldman Sachs index tracking the group saw all of its post-election gains relative to the broader market erased by mid-March. Now, amid rising optimism around some sort of tax cut, it's been ticking up in recent weeks.

It's important to note that even if Trump's desired 15% rate ends up being slightly higher, these companies will still see a material benefit to their bottom line. JPMorgan estimates that if the statutory tax rate is cut just 10 percentage points to 25%, that would boost the S&P 500's earnings per share by $11.40 to $143.40 — and add more than 150 points to the index, which closed at a record high of 2,500.23 on Friday.

The companies holding the most cash overseas

Another area of the Trump tax agenda that's expected to be included in the upcoming tax plan is a repatriation tax holiday. The measure would incentivize multinational companies who make a large portion of their earnings overseas, and then hold that cash internationally, to bring it back into the US.

Strategists at Citigroup estimate that US corporations are holding a whopping $2.5 trillion of cash overseas.

As the chart below shows, investors who were initially enticed by the prospect of a repatriation tax holiday gave up on the trade midway through January. The subsequent recovery over several months can be more attributed to the fundamental performance of large US multinationals who do big business internationally — Google, Facebook, Amazon — than to anything relating to tax measures.

However, the recent spike in a Goldman Sachs-maintained index of companies with high overseas earnings is best explained by policy optimism.

Source: Businessinsider

Trader I. Ivanov

http://www.businessinsider.com/stock-markets-reacting-to-republican-tax-cut-plan-2017-9

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.