- Home

- >

- Stocks Daily Forecasts

- >

- Traders believe that the rally Trump is questionable

Traders believe that the rally Trump is questionable

Stocks have been on a seemingly unstoppable rally. However, the bond market is signaling that this could be over soon.

The Dow Jones industrial average closed in record territory on Monday for the 12th straight day — something that hasn't happened since 1987. Since the election of Donald Trump, the broader S&P 500 has tacked on more than 10% and climbed to new heights.

The gains have come amid a resurgence in consumer confidence, which hit a 15-year high in February amid Trump's promises to cut taxes, roll back regulation, and spend on infrastructure.

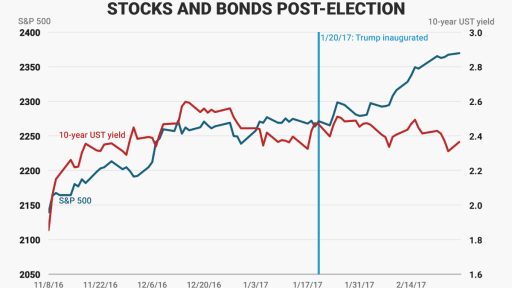

At first, it seemed the stock and bond markets were in sync. As stocks rallied right after the election, bonds sold off for roughly the same reasons. Yields on the benchmark 10-year Treasury note rose to a high of 2.64% in the middle of December — yields move opposite prices — reflecting expectations that the economy would grow faster than it has and that Trump's infrastructure spending might spur inflation.

But in the month since Trump became president, the relationship has started to change. Since the inauguration, stocks have rallied, but buyers have also returned to the bond market.

The benchmark 10-year yield has fallen 13 basis points since January 20 and is flirting with its lowest level since the end of November.

Why is this happening?

One reason, according to Capital Economics, is the recent weakness in the US dollar. After topping out at 103.82 on January 3, the dollar has weakened against a basket of its peers, pulling back into the area of 100. As Capital Economics notes, dollar weakness is "good news for the multinationals that dominate the S&P 500" — hence, stocks keep rallying.

But the rally in the bond market could be attributed to a different factor that's bad for the markets. That can be explained by recent headlines that say Trump's proposed stimulus plans would take longer to implement than previously expected and that the stimulus would be less expansionary than first thought. Put another way, a key aspect of how Trump would goose the economy is likely to fall short of expectations both in terms of its effect on growth and inflation. Capital Economics concludes that it's "hard to comprehend the latest surge in the stock market."

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.