- Home

- >

- Opportunities for profit today

- >

- Trading opportunities during the Asian session 30.10.2017

Trading opportunities during the Asian session 30.10.2017

1. AUD/USD

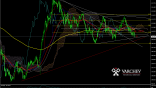

The pair is at key levels after the formation of a reversing triangle on the downward trend started in September 2014. Currently, the price retrace to levels of horizontal support, coinciding with 61.8% Fibonacci retracement, and goes back to the figure. The price is close to a short diagonal. We have a bullish pin bar at support levels but completely closed under the upper diagonal of the triangle and 200SMA - a negative signal for the price. Dem(14) is still in neutral territory and points down a deeper adjustment. The price is in a narrow range between the support zone and the resistance. Taking into account the characteristic penetration of the price back into the figure after a breakthrough, probabilities are for Long, albeit at risk from the current levels. Input would be useful after a 50% correction of the SL: pin bar at around 0.75751.

2. NZD/USD

Here the price movement forms a broad consolidation starting in September 2016. Currently, the price is at the bottom of the consolidation, forming a bullish reversing bar. Levels are key, and we expect increased volatility and fight between buyers and sellers. The price is currently giving us good purchases because we still do not have a breakthrough. Long of the current positions must be well thought out with a distant SL or a waiting short position to activate after a horizontal break. Dem(14) is in a surplus sales area, not yet signaling for purchases. 50SMA crosses 200SMA - negative for price.

Consolidation chart NZD/USD D1

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.