- Home

- >

- Trading University

- >

- Trading the Shooting Star Candlestick Formation

Trading the Shooting Star Candlestick Formation

What is a Shooting Star candlestick formation?

The shooting star consists of a long upper shadow (at least 2x the length of the real body) with a relatively small real body at or near the bottom of the range of the candlestick. The color of the real body does not matter, and it can have a small lower shadow.

The shooting star, like many other candlestick formations that we will be discussing, must be traded within the context of the market. A true shooting star signal must come after an uptrend (see image below). Trying to trade the shooting star pattern from a neutral market can be disastrous.

A shooting star is a reversal signal, and unlike most other price action formations, this one can does not need another candle for confirmation. The candle itself is the signal, but this does not mean that the market is guaranteed to reverse – only that the market should be hitting an area of resistance.

Trading the Shooting Star Candlestick Formation

You must be prepared to risk at least the length of the upper shadow of your shooting star candlestick. The top of your shadow is typically a good place for a stop loss, because if the market breaks through that level, your shooting star signal is a dud.

In the real world, even great looking signals fail from time to time. Keep in mind that the market can and will do anything at any time. Successful traders try to stay out of the market until the odds are in their favor, but there will always be odds.

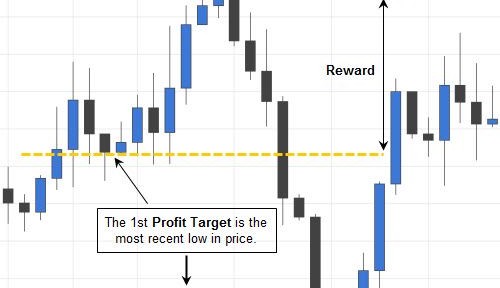

You should only take a trade if your potential profit is at least twice your risk. How do you determine a potential take profit level? When trading the shooting star, your first profit target would be the most recent low in price (see the image below).

The distance from your potential entry point to the most recent low in price (your first profit target) should be 2x that of the distance from the same entry point to your stop loss (above the shooting star + the spread in Forex). If those conditions do not exist, you should avoid the trade. Click here to learn more about money management.

*Useful Tip: Want to lower your risk and raise your potential profit on a shooting star signal? A skilled price action trader knows that price more often than not returns to at least 50% of the entire shooting star candlestick (shadows included) before selling off, if you are using this signal correctly. Keeping this in mind, the 50% mark makes a great entry point for this signal (see picture above). Also, as you can see from the first picture on this page, the “50% entry” doesn’t work every time.

In the picture above, you could have entered the trade after price reached 50% of your shooting star signal. Taking your profit at the most recent low, you would have made a profit nearing 4x that of your risk.

As you can see, the shooting star is a great signal to learn for Forex or any technical trading. It provides a great take profit signal in an uptrend, or a possible reversal signal for sell positions. Price action signals like the shooting star candlestick formation are very useful for scalping, because they are highly relevant in the short term.

Trader Nikolay Georgiev

Trader Nikolay Georgiev

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.