- Home

- >

- Daily Accents

- >

- Trump’s $2.5 Trillion Moneybomb Detonates Soon

Trump’s $2.5 Trillion Moneybomb Detonates Soon

You’ll recall, President Donald Trump promised to slash corporate taxes and set up a one-time tax holiday to repatriate cash held in foreign countries. If the health care reform failure is any indication, tax reform or even just a tax holiday won’t come easy. But it’ll come. And once it does, it promises to trigger one of the largest one-time wealth transfers in the history of capitalism. How do we grab our share of the fortune? As you’ll see in a moment, it shouldn’t be too difficult.

Bring Home the Money

U.S. companies are hoarders. Because of onerous tax regulations, they’ve stashed an estimated $2.5 trillion in profits in overseas tax havens. That amounts to about 10% of the entire market cap of the S&P 500 index. So this isn’t mere pocket change.

Granted, not all of that money is parked in cash. Some is tied up in plant and inventories — making it illiquid. But there’s still a ridiculous amount of cash desperate to make its way back home at lower tax rates.

And the first part of profiting from this gigantic repatriation windfall is distinguishing between sectors and companies with empty pockets and ones with Constanza walletsoverstuffed with cash.

Armed with the data, it’s abundantly clear what sectors are the highest-value targets — technology and health care.

At the end of 2015, S&P 500 technology and healthcare companies collectively reported over a trillion dollars of untaxed foreign profits — or roughly 50% of the total. No other sectors come close to hoarding as much.

Drilling down to the company level, it’s clear the cash is not only concentrated in a handful of sectors, but a handful of companies, too.

For investors, there are two ways to play this reality…

Almost Forgotten History

Most investors fail to realize that the U.S. enjoyed a one-time tax holiday in 2004, making it easy to predict what companies will do this time around. The same thing!

In 2004, U.S. firms repatriated over $300 billion, and stock buybacks rose 84%, according to an analysis by Goldman Sachs. In this case, correlation does imply causation.

Buybacks have already been a major outlet of excess cash — and, in turn, the driver of the latest bull market. That’s because fewer shares outstanding increases earnings per share. Check out the Nasdaq Buyback Achivers Index for proof.

The index tracks the stock performance of U.S. companies that have repurchased 5% or more of outstanding shares over the trailing 12 months.

Giving executives even more cash promises to increase such activity.

Or as Goldman’s chief U.S. equity strategist David Kostin says, “A significant portion of returning funds will be directed to buybacks based on the pattern of the tax holiday in 2004.”

The easiest way to benefit from this trend is to buy the index.

Instead of trying to predict the individual companies that will boost buyback activity the most, we can own them all via the PowerShares BuyBack Achievers ETF (PKW). Of course, buybacks won’t be the only outlet for cash. Many firms will plow repatriated cash into mergers and acquisitions. As Ethan Lovell, a portfolio manager at Janus Capital Group, told Bloomberg, “The vast majority of companies that I speak with want to make acquisitions. Their first order of business is build the business and enhance the growth rate.” The most obvious targets are small- and midcap players with innovative technologies or treatments. Like Visteon Corp. (NYSE: VC) or Zynerba Pharmaceuticals Inc. (NASDAQ: ZYNE). Both are compelling buys at current prices.

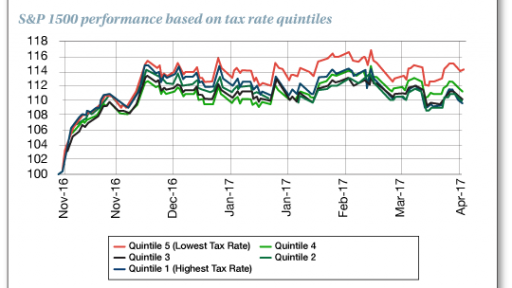

Here’s the best part about the Trump “Moneybomb” trade — Wall Street is completely downplaying the possibility, which sets the stage for even bigger gains. A recent analysis by Jefferies found the companies that stand to benefit the most from tax reform are performing the worst since the election. As one mentor likes to remind me, there are only two classes of investors on Wall Street — contrarians and victims.

Right now, the victims are lining up, betting against any meaningful tax reform or holiday. Don’t join them. Bet against them.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.