- Home

- >

- FX Daily Forecasts

- >

- TRY again under pressure, the central bank remains powerless

TRY again under pressure, the central bank remains powerless

Concerns surrounding the diplomatic dispute between the US and Turkey completely overshadowed the attempts of the Turkish Central Bank to support the currency. The Pounds carried another four percent Crash after Turkish President Recep Erdogan said he would respond to sanctions for the detained US pastor in kind. With the decrease in TRY, Turkish central bankers changed the rules for reserves to increase the liquidity of banks in foreign currency - a measure that analysts say insufficient to support the pound.

With the pound that is subject to extremely strong pressure and a decline of 28% for the year, the ability of companies to repay their loans in foreign currency is almost impossible. High inflation, in turn, puts pressure on the central bank to continue raising interest rates. The next Central Bank meeting is scheduled for September 13, when investors expect to hear a decision from central bankers. Actually, however, we are unlikely to get that. I would rather expect the CB to confirm the deadlock caused by the controversial Erdogan government.

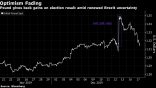

Despite the decline in the pound in recent years, the volatility (on the main chart) seems to have remained at low levels, but after the US intervention as well as the country's election, the indicator remained at levels above 20 points, which is far higher than average value.

Source: Bloomberg

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.