- Home

- >

- FX Daily Forecasts

- >

- Turkey crisis in charts, what to expect

Turkey crisis in charts, what to expect

On the first day of the week, the currency crisis in Turkey remains the most commented topic of the financial markets. The country has sank into one of the worst currency crises in the history of emerging markets, with no signs that it will end soon. TRY declined by nearly 30% as President Erdogan was re-elected in June this year.

With the pound melting, the cost of trading in the currency has risen dramatically. What is most affected by TRY traders is the increase in spread. On the chart below, we can track the level of backwardness in the years.

It turns out that the current spread levels are many times higher than the financial crisis in 2008. and close to the market adjustment in 2015. Although it did not reach 2015. Poor liquidity points to a dysfunctional market.

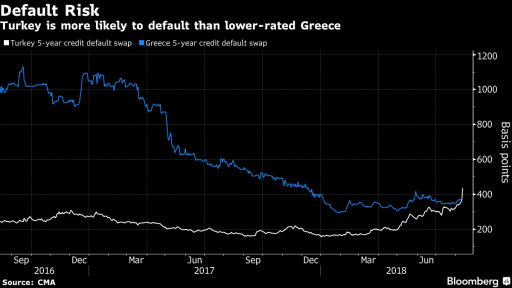

The weakness of the pound makes Turkish borrowers face the impossibility of repaying foreign currency loans. As a result, the country's default risk increased, which in turn increased the cost of insurance against such an event through swaps. Current pricing for CDS implies a 25% probability of non-payment over the next five years.

The lack of national sources of funding makes Turkey turn to foreign investors to keep its costs. Turkey's funding is currently reminiscent of the funding seen before the Asian currency crisis in the late 1990s and the debt crisis in Latin America in the 1980s.

USD/TRY - Technically, what we need to consider is the filling of the gap formed last night and the strong reaction in the upward direction. This clearly shows the strength of the bulls that use each correction to add to the long positions.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.