- Home

- >

- Daily Accents

- >

- Turkey enters into recession in a decade

Turkey enters into recession in a decade

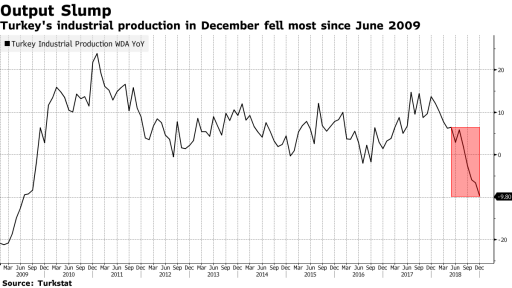

Turkey has plunged into its first recession in a decade, which is a blow to President Recep Tayyip Erdogan, at a time when the country's local elections will be held this month.

Gross domestic product fell seasonally by 2.4% in the fourth quarter, and previous data was revised to 1.6%, according to data released Monday. This corresponds to the average estimate of economists in a Bloomberg survey. Year-on-year, GDP fell by 3%.

Driven by Erdogan's drive for growth at all costs and pressure on the central bank to maintain low interest rates, capital poured into Turkey during the era of record monetary stimulus around the world. But the almost continuous expansion that supported the economy, averaging nearly 7 percent growth each quarter since the end of 2009, disappeared after a currency crash, improper political steps, and an unprecedented diplomatic rupture with the United States.

"This is an accusation against Erdonomics and a direct consequence of monetary policy in 2018, conducted in the interests of short-term political expediency rather than economic pragmatism," said Julian Rimmer, a trader at Investec Bank Plc in London.

Despite the fall, Finance Minister Berat Albayrak said the worst is now behind Turkey and the economy is on track for a quick recovery. Increasing exports and incomes from tourism will be the key drivers of growth, he told Twitter.

Piraeus declined 0.5% after releasing the data and traded 0.2% lower at 5.4489 per dollar at 10:32 am In Istanbul. This is the third weakest emerging market economy in 2019 with a loss of around 3% against the US currency.

EURTRY chart, as the USDTRY technical levels situation is the same, we see a relatively tight consolidation, but the basic diagonal of the downward correction is pierced. The likelihood of promotion in these pairs remains higher. The conservative option is to wait for the core diagonal test, with DeM (14) in a fairly redeemed area, and a slight correction is not excluded. The other positioning option is above diagonal resistance (bright green line). For now, the best option is to wait or use limit and stop orders.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.