- Home

- >

- Stocks Daily Forecasts

- >

- Two big forces could thwart this clockwork stock market rally come August

Two big forces could thwart this clockwork stock market rally come August

The stock market has been stuck in low gear—in the best possible way.

Think about it: Driving in low gear is no good for going fast, but is great for climbing. And when the declines come, staying in low gear makes the descent more controlled and safer.

This pretty well captures the way the S&P 500 index has moved to a 10 percent gain this year in what's arguably been the calmest market of all time.

We are one year removed from the last five-percent pullback, and it's been nearly nine months since even a three-percent dip. The majority of times in its history the CBOE S&P 500 Volatility index has settled below 10 have come in the past few months.

Two things are undeniable: History says that August tends to bring a tougher path for stocks, and the current market has not obeyed seasonal patterns much at all.

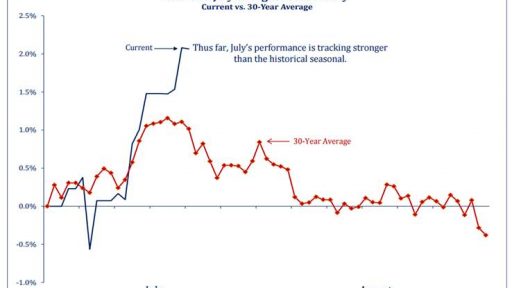

The nearby chart from Strategas Research shows the S&P 500 far outperforming the "typical" track, and any closing of the gap would mean a long-delayed setback for the index. Others are pointing to broader patterns involving the four-year election cycle and a high incidence of market accidents or peaks (coincidental or not) in years ending in 7.

Two years ago we entered late July with the same sort of resilient, low-volatility action—that one far more dominated by a handful of tech stocks than today's market is—and hit turbulence in late summer that started a brutal correction. But that required an oil collapse, global industrial downturn and "earnings recession," none of those evident right now.

The bottom line is, seasonal risk is something to bear in mind. Yet February was "supposed" to be weak and this year was strong; May has a tough reputation and this year the market barely hiccuped.

The market's humbling of the bears has pulled many converts into the bullish crowd. Even those strategists who have correctly been positive on the market are flagging some surveys of professional investors that show optimism rising toward levels that can be a restraint on further short-term upside.

Jeff deGraaf of Renaissance Macro says: "The latest Investors' Intelligence and Consensus Inc. [survey] figures show 90-100th percentile readings in bull categories. Simply put, this shows that there are more bulls than bears in the market right now. With the market showing green lights across the board, this represents one of the few headwinds."

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.