- Home

- >

- Stocks Daily Forecasts

- >

- U.S equities snaps 5-day losing streak

U.S equities snaps 5-day losing streak

The major stock indexes snapped multiday losing steaks Thursday as J. P. Morgan Chase led banks higher and iPhone maker Apple rebounded after dipping into bear market territory earlier in the week.

The Dow Jones Industrial Average erased a 200-point loss to finish the day up 208.77 points at 25,289.27 as both Apple and J.P. Morgan climbed about 2.5 percent. Caterpillar rose 3.4 percent, while Walmart and Home Depot both weighed on the blue-chip index.

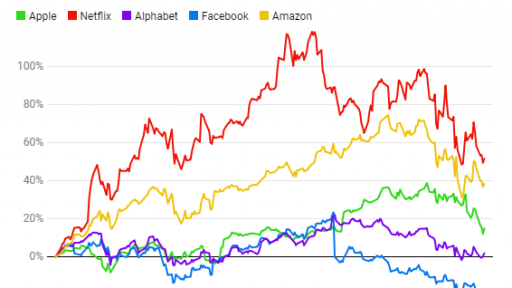

The S&P 500 rose more than 1 percent to close at 2,730.2 as gains in financials, energy and technology offset losses in utility stocks. The tech-heavy Nasdaq Composite added 1.7 percent to climb to 7,259.03 as Alphabet added 1.5 percent and Netflix gained 1.1 percent.

The gains Thursday snapped a five-day losing streak in the S&P 500 and a four-day losing streak in the Dow.

Equities also appeared to rally in afternoon trading following a report said that the U.S. and China have doubled down on efforts to reach an agreementin the growing trade war, at the Group of 20 meeting later this month.

Representatives for President Donald Trump and China President Xi Jinping have intensified efforts to strike a deal following a phone call between the two leaders earlier this month, according to a Financial Times report. China reportedly responded to Washington's requests to deal with a range of American grievances, and the possibility of concessions was reviewed.

One person familiar with the situation told the FT that U.S. Trade Representative Robert Lighthizer has already informed some industry executives the next wave of tariffs was already on hold.

Financials were up on the day as J. P. Morgan buoyed the big banks higher after famed investor Warren Buffett's Berkshire Hathaway disclosed a new $4 billion stake in the company. Bank of America, also part of the Berkshire portfolio, rallied 2.5 percent. The SPDR S&P Bank ETF rose 1.7 percent.

Walmart missed on revenue estimates in the third quarter, contributing to a 1.9 percent drop in shares. Though the company reported strong e-commerce sales and raised full-year guidance, the sales miss and news that Buffett dissolved his stake in the company weighed on the stock.

"The hard part for most investors is not so much that earnings are disappointing or not ... the real issue is what's going to happen next year," said Bruce McCain, chief investment strategist at Key Private Bank. "There's a sense that it can't get too much better. Looking forward, with the market turmoil overseas and the recognition that the effect of the tax cuts will begin to wane, it's hard to think it'll get better."

Sterling plunged by over 1.6 percent against the dollar Thursday morning after UK Brexit Secretary Dominic Raab resigned from his post. This piles yet more pressure on UK Prime Minister Theresa May as she tries to get her draft Brexit agreement through Parliament.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.