- Home

- >

- Fundamental Analysis

- >

- U.S. futures drop, yen gains – market wrap

U.S. futures drop, yen gains - market wrap

The yen rose and U.S. equity-index futures fell while Asian stock markets opened mixed as investors sifted through the latest news on the Trump administration.

The Japanese currency rose against all its major peers and S&P 500 futures dropped after the Washington Post reported Donald Trump asked intelligence chiefs to publicly deny any collusion between his campaign and Russia.

The pound slipped after the BBC reported police are treating a blast at an Ariana Grande concert in Manchester as possible terrorism.

The selloff in Brazilian assets resumed, and the Mexican peso slid after S&P put Brazilian debt ratings on creditwatch for a possible downgrade.

Global equities are within a whisker of a record high amid optimism over global growth, though concern over turmoil in Washington continues. The U.S. president in March asked Director of National Intelligence Daniel Coats and NSA Director Michael Rogers to publicly deny existence of any collusion between his campaign and the Russian government, the Washington Post reported, citing unidentified current and former officials.

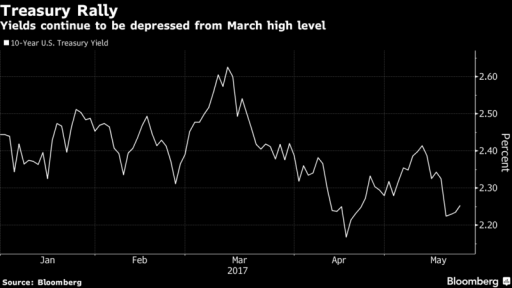

Money managers will be scrutinizing minutes to be released this week from the Federal Reserve’s latest meeting for clues on the trajectory of U.S. monetary policy after recent data showed all was not well for the world’s largest economy. The concern is centered on U.S. inflation after March and April figures missed estimates.

Analysts from JPMorgan Chase & Co. and Goldman Sachs Group Inc. have over the past week lowered forecasts for where Treasury yields will be trading at the end of this year, questioning the extent to which interest rates can climb.

Source: Bloomberg Pro Terminal

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.