- Home

- >

- Daily Accents

- >

- Unemployment falls to pre-crisis low from 2007

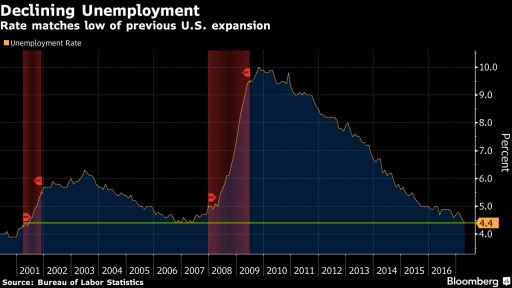

Unemployment falls to pre-crisis low from 2007

U.S. payroll gains rebounded in April by more than forecast and the jobless rate unexpectedly fell to 4.4 percent, signaling that the labor market remains healthy and should support continued increases in consumer spending.

The 211,000 increase followed a 79,000 advance in March that was lower than previously estimated, a Labor Department report showed Friday. The median forecast in a Bloomberg survey of economists called for a 190,000 gain.

The unemployment rate compares with economists’ projection for 4.6 percent. It’s now below the 4.5 percent level where Fed policy makers in March had forecast it would reach in the fourth quarter, based on their median estimate.

Immediately after better data for the US labor market, the probability of raising the key interest rate at the next Fed meeting rose to 100%. The probability of raising to 1.25% is set at 98.8%. From the table below, we can trace analysts' expectations for the next hikes.

“The labor market has progressively gotten tighter and tighter,” Jim O’Sullivan, chief U.S. economist at High Frequency Economics Ltd in Valhalla, New York, said before the report. The job-growth trend is “pretty strong, relative to the demographics -- more than enough to keep unemployment down over time.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.