- Home

- >

- Daily Accents

- >

- Unemployment increases bear forces at the Dollar Index

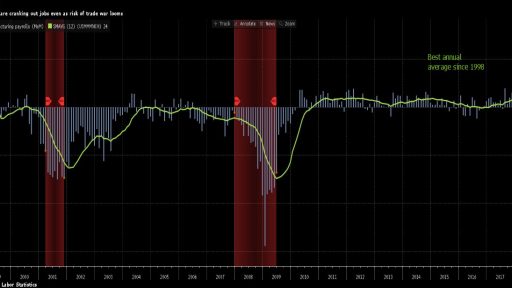

Unemployment increases bear forces at the Dollar Index

At the end of the week, we received US unemployment figures. This indicator is one of the most important for the US economy because it determines the market trend in the short term.

The new jobs report, which showed more than 200,000 new jobs in May, allowed market participants to talk about the continued development of the US economy. This, along with the many good economic data coming from the United States, completely eliminated the suspicion that the Fed will rethink its forecast for 4 interest rises.

Weak indicators will cause a wave of anxiety. In this way, the dollar can be held hostage to the strong economic performance in the recent past.

US factories are increasing jobs, even with the growing risk of a trade war with China, Europe and other trading partners in the United States. In June, jobs in the manufacturing sector increased by 36,000 people.

USA - Non Farm Payrolls 213K vs. 195K expected, but unemployment rate is growing to 4%

Technical Dollar Index failed to break the key resistance level, with Unemployment data being crucial to the direction of the dollar. Unemployment is one of the main factors that determine the economic conjuncture of an economy. The increase in unemployment is a negative indicator and the decrease is positive.

Chart: Used with permission of Bloomberg Finance L.P.

Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.