- Home

- >

- FX Daily Forecasts

- >

- Unique US Negotiations on NAFTA sent CAD to a new bottom

Unique US Negotiations on NAFTA sent CAD to a new bottom

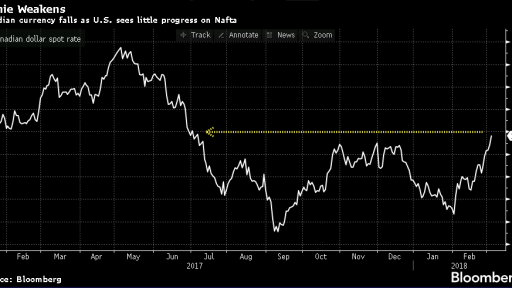

The Canadian dollar dropped sharply on Monday after US Trade Representative Robert Lighthiser said the time for agreement is on the way, and Canada and Mexico have not shown their intention to change the deal. Against this background and partly due to slower oil growth, the Canadian lost 3.1% from the beginning of the year. And, according to a large number of market participants, the bad for CAD is yet to come.

Despite terse US holdings, Trump believes it makes sense to exclude Canada and Mexico from the additional industrial metal levy he plans to introduce later this year. "I think this is a good enough incentive for countries to conclude a new NAFTA deal," Trump said. On the other hand, Mexico and Canada have announced they can very quickly prepare retaliatory measures if Trump takes sole action on NAFTA.

What we need to take into account is that neither Mexico nor Canada are in good economic condition to contradict the United States. Mexico will face elections in a few months, and Canada's economy is still lagging behind leading world leaders.

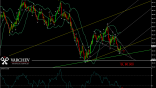

Technical USD / CAD managed to break the long-term consolidation that began in July 2017. The mid-term movement remains a longevity, and given the strong dollar and impending changes in NAFTA and US import duties, the momentum is getting stronger. Following a statement from the US sales representative, the couple managed to cross the levels of horizontal resistance and broke a 50% Fibonacci correction on the downward trend - the beginning of a new upward trend. Price above SMA 200/50 - positive signal. To minimize risk, we can look for better positioning around the 1.2930.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.