- Home

- >

- Fundamental Analysis

- >

- US economy expectation is on record level, when the USD will wake up

US economy expectation is on record level, when the USD will wake up

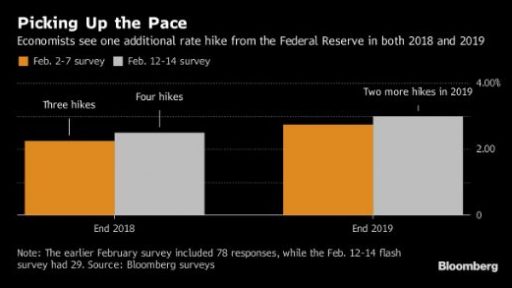

The growing number of economists' positive expectations about how many times the Fed will raise interest rates in 2018. makes investors increasingly think that 4 hikes will be in place by the end of 2018. The main reason for big expectations is the $300 billion budget plan, which is expected to significantly boost economic growth and inflation in the country.

According to a study by Bloomberg, which involved 29 analysts from major investment banks, 100% of them believe that by the end of 2018, US interest rates will reach 2.5%. According to Lewis Alexander chief economist at Nomura Securities, the strong growth expected in 2018. will make the Fed raise interest rates four times this year and twice more in 2019.

The rumors that weak retail sales in January will hinder the Fed's plans are unfounded. Low retail sales in January are common and are caused by high consumer spending before Christmas and New Year holidays.

Regarding the growth of the US economy, analysts are of the opinion that at the end of 2018 we will see GDP at 2.9% and in 2019, 2.5%. For comparison, we can say that the average GDP value in the years since 2009 is 2.2%.

Inflation expectations also rose to an average of 2% at the end of 2018, compared with 1.7% a year earlier.

In spite of all these good data, USD marks another day of decline. Dollar index traded 0.34% today after testing the record low of 88.58 points. This, in turn, supports the stock markets and raises the price of gold at the same time. We expect the USD to start reflecting good economic data only when the Fed begins to raise interest rates and economic data support it.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.