- Home

- >

- Fundamental Analysis

- >

- US market – Risk appetite and Q3-reports In the Spotlight

US market - Risk appetite and Q3-reports In the Spotlight

U.S. stock index futures pointed to a slightly higher open on Monday as third-quarter earnings season gets underway, after minutes of last month's U.S. Federal Reserve meeting failed to illuminate the pathway ahead for U.S. monetary policy.

A further element of chaos in USD import trade flows of developing countries, since a large part of their debt in dollars and this is the currency of any real need. But they have no guaranteed lender of last resort and can only rely on the available reserves, which shows that it is not enough. Companies with debt and deposits in dollars also fail to fully control changes in interest expenses and profitability.

Many analysts believe that revenues from the upcoming reports will be crucial to the trend in the fourth quarter and will bring more clarity there economic slowdown amid mixed messages from the Fed. That in the coming days will be combined with data on Tuesday from China on the trade balance and on Wednesday and Thursday when the US will present figures for retail sales and very important for inflation, consumer price index.

Many analysts say the earnings reports are critical for fourth-quarter gains in stocks and finding clarity on the severity of an economic slowdown, especially amid mixed messages from the Federal Reserve.

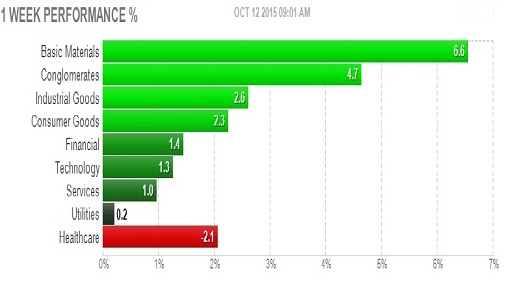

Expectations for today is bullish on shares impulse characteristic of last week to continue cautiously driven data reports.

The financial sector is usually considered an early indicator of broader movements. Forthcoming reports with data from the largest banks and the forecasts are positive.

Wells Fargo – the estimates are that this San Francisco-based bank will show earnings of $ 1.06 per share. That would be up from $1.02 per share in the same period of last year.

Bank of America will post earnings of $0.37 per share for its third quarter. That would compare to a net loss $0.04 per share in the same period of last year.

Citigroup is expected to say that its earnings per share came to $ 1.42. That compares to the $ 0.88 per share Citi posted in the year-ago period.

JPMorgan forecast for this financial titan calls for EPS to have risen from $1.36 in the year-ago period to $1.45.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.