- Home

- >

- Market Rumours

- >

- US policy uncertainty offers equity opportunities

US policy uncertainty offers equity opportunities

A rising tide may no longer be lifting all boats. Volatility for the US stock market as a whole has fallen since November’s election, but investors can still find ample returns in projecting how the policies of the new administration will impact individual companies.

Policy uncertainty stemming from the Trump administration will create ‘winners’ and ‘losers’ and stock performance increasingly will be driven by idiosyncratic factors, such as sensitivity to wage inflation, margin pressures, and uses of cash.

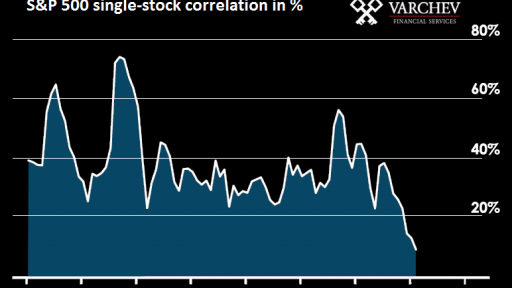

The trend has already begun to take shape, with the correlation between individual stocks listed on the S&P 500 declining after the election of Donald Trump to the lowest level since 2000. Recent trading has been increasingly driven by ‘micro factors’

Тhe dispersion in returns between stocks will accelerate this year as investors make sense of the policies that are ushered in by Mr Trump and a Republican-controlled Congress.

It is expected the uncertainty to remain elevated throughout much of 2017, as President Trump’s key policy initiatives become crystallized and the impacts of the new administration are fully processed by the market.

Greater return dispersion does not ensure that all fund managers will outperform their benchmark but rather the investing environment is more conducive to generating alpha for skillful stock pickers.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.