- Home

- >

- FX Daily Forecasts

- >

- USD/CAD trying to get rid of the pressure of the sellers

USD/CAD trying to get rid of the pressure of the sellers

- WTI is nearing $ 62, which keeps CAD staying strong

- The US dollar index continued its downward trend after falling 0.7% last week.

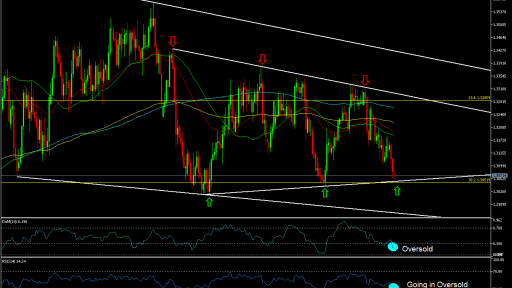

The USD / CAD pair closed 160 points last week, driven by rising crude oil prices and pressure from sellers around the dollar. After touching its two-month low of 1.3062 on Friday, the pair has moved into a consolidation phase at and is currently up 0.06% for the day to 1.3069.

The easing of the protracted US-China trade war and good macroeconomic data from China helped crude oil maintain its bullish momentum towards the end of the year. West Texas Intermediate added 2.17% last week and registered weekly earnings for the fourth consecutive time. This has helped the oil-sensitive Canadian dollar outperform its main competitors. Currently, WTI reports modest daily gains of nearly $ 61.80.

On the other hand, green money is struggling to find demand, despite the lack of basic fundamentals. The bullish sentiment, reflected by rising global indices over the past week, has hampered the demand for US dollars. The US dollar index lost 0.7% last week and continued to fall lower on Monday. At the time of writing, the index has dropped 0.25% on a daily basis to 96.83.

Technically speaking, the price is about to reach strong diagonal support as well as 38.2 Fibo designed on a weekly schedule. At the same time, the RSI and DeM indicators are entering resale territory. This gives us a signal that downward movement is possible to complete and buyers to re-enter the market.

In addition, if the price breaks the diagonal support and 38.2%, then we can see a long decline, but the next diagonal support, which is 1.2970.

Trader Milko Zashev

Trader Milko Zashev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.