- Home

- >

- FX Daily Forecasts

- >

- USD/CHF – Good long entry point with the new trend

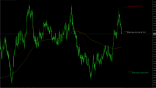

USD/CHF - Good long entry point with the new trend

Our expectations: The short-term trend remains elevated after a breakthrough in basic diagonal resistance and a follow-up test - successful. I expect the price to continue its rise.

What we have in support of long positions - The price is in a support zone formed by long-term and short-term diagonal support, 50SMA, horizontal support, and 23.6% Fibonacci correction of the short-term trend. There is a breakthrough and a long-term diagonal test. The Fibonacci 50% Fibonacci correction of the long-term downward trend (Gray Fibonacci Retracement on the graph) is broken, which means that the trend is no longer in place. Price Action - a bullish reversing bar combined with a bullish pin bar that confirms the importance of the area. Indicators - CCI 50 remains above 0, the upward trend is in effect. The CCI 14 crosses -100 from bottom to top indicating the start of a new upward momentum in the trend.

SL: 0.97954

In addition from the CFTC, it was clear that Swiss net speculative positions grew by nearly 20% to -43.4K, indicating that big players still prefer to be short on CHF.

Alternative Scenario: If the price goes back below the support area and stays there, the positive scenario will be spoiled and more likely to see a decrease in the pair's price.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.