- Home

- >

- FX Daily Forecasts

- >

- USD/JPY – Shorts still more likely

USD/JPY - Shorts still more likely

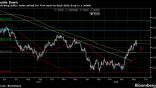

USD/JPY D1

Our expectations: The price has reached a strong resistance zone for the third time as vendors have again shown that they tend to sell out sharply from there. I expect the dollar to retreat against the JPY and the pair to remain in the bearish main trend that began in the beginning of 2017.

Looking at the couple's daily chart, it becomes clear that the price reaches a resistance zone formed by a strong horizontal and a major diagonal. In the first test the price has reached 50% Fibonacci correction, after which it registered a strong decline. At the last rising impulse, the price did not touch 50%, but it is still near, recording a strong twist. DeMarker is also supporting DeMarker, who swings from the over-buy zone and points down - negative for the price. 50 and 200SMA remain in place. Price Action: absorbing bar at resistance levels - negative for the price. Given the strong resistance zone, it is good to move over 50% of Fibonacci in order to avoid Stop Hunting, which we can expect on Thursday and Friday when NFP data will be published.

SL: 111,919

Alternative scenario: If the price breaks through the resistance zone and stays there in several consecutive bars, the negative scenario will break and we are more likely to see an increase in the USD against JPY.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.