- Home

- >

- FX Daily Forecasts

- >

- USD/TRY – Euphoria end, time to buy

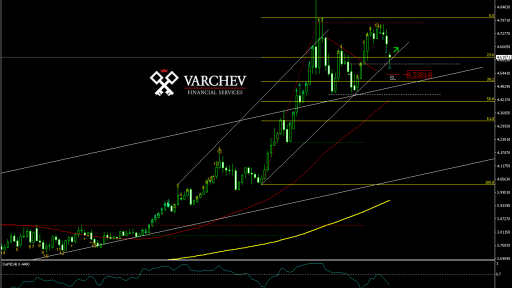

USD/TRY - Euphoria end, time to buy

Despite the strong victory of Erdogan in the presidential election and the highest percentage gain in parliament, the USD/TRY remains on the upside, indicating that the Turkish lira is yet to weaken.

I expect investors to remain negative towards the Turkish currency as there will be many changes in the country with uncertainty as to how they will affect the economy. Turkey becomes a presidential republic and the first and biggest change that will follow is that the next government will not have a prime minister. The newly elected president will also take over the functions of prime minister, and the government will be subordinate to him. The new head of state will be able to legislate alone, elect and appoint ministers and senior judges, and prepare the country's budget.

Given the temperament of Erdogan and his plans for the central bank, I expect USD/TRY to continue the upward movement. The euphoria around the election gives us good levels for positioning with long positions. The USD/TRY trade starts with a downward trend and the price tests the support zone formed by horizontal, diagonal and 23.6% Fibonacci correction and is currently rebounding upwards. The pair manages to stay in the ascending channel, and the current price gives us a rare positioning capability with a maximum braid stop. Price Action: A 4-hour bull pin bar showing the firm position of FX traders versus the Turkish Pound. 50 and 200SMA remain beaded. DeMarker 14 remains neutral.

SL: 4.5381

Alternative Scenario: If the price goes below the support area and stays there, the positive scenario will be spoiled and more likely to see a decline.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.