- Home

- >

- FX Daily Forecasts

- >

- USDCAD back up to the pre-employment day low level – now what

USDCAD back up to the pre-employment day low level - now what

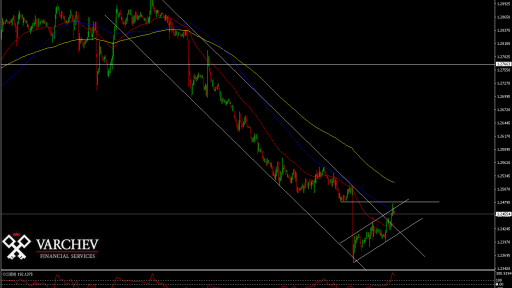

USD / CAD is trading today with an increase. The rise (weak CAD) moves reversely to the price of oil, which is 1.77% up today. Generally, black gold supports the Canadian, and this is also in contrast to the fundamental (extremely strong employment data in Canada on Friday). The BoC meeting is next week, and the moods are that the bank will raise its interest rates by 0.25 points to 80%.

Technically speaking, the pair climbed to 1.24773, which is just below the levels on Friday, when employment growth was well above expectations in Canada. The price broke diagonal resistance and traded over 100 EMAs at 1.24623 short-term. A 100 EMA breakthrough occurred last December 20th.

However, the movement over the period did not attract many purchases and the price fell again (currently traded around 1.24553.

The market seems to doubt the power of the bulls here.

What would help sellers from now on. For me, if the price:

-Is below 1.24807

-It can not close a bar above 100 EMA and

- Went back to the descending channel around 1.2430

These conditions will give absolute control to the bears. In the event of failure, the price will give the retracement buyers the opportunity to go long with target 200 EMA at 1.2513

For now, bears are trying to take things under control. If the price remains below 100 EMA, it is definitely a bearish signal.

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.